Identity Theft & Impersonation

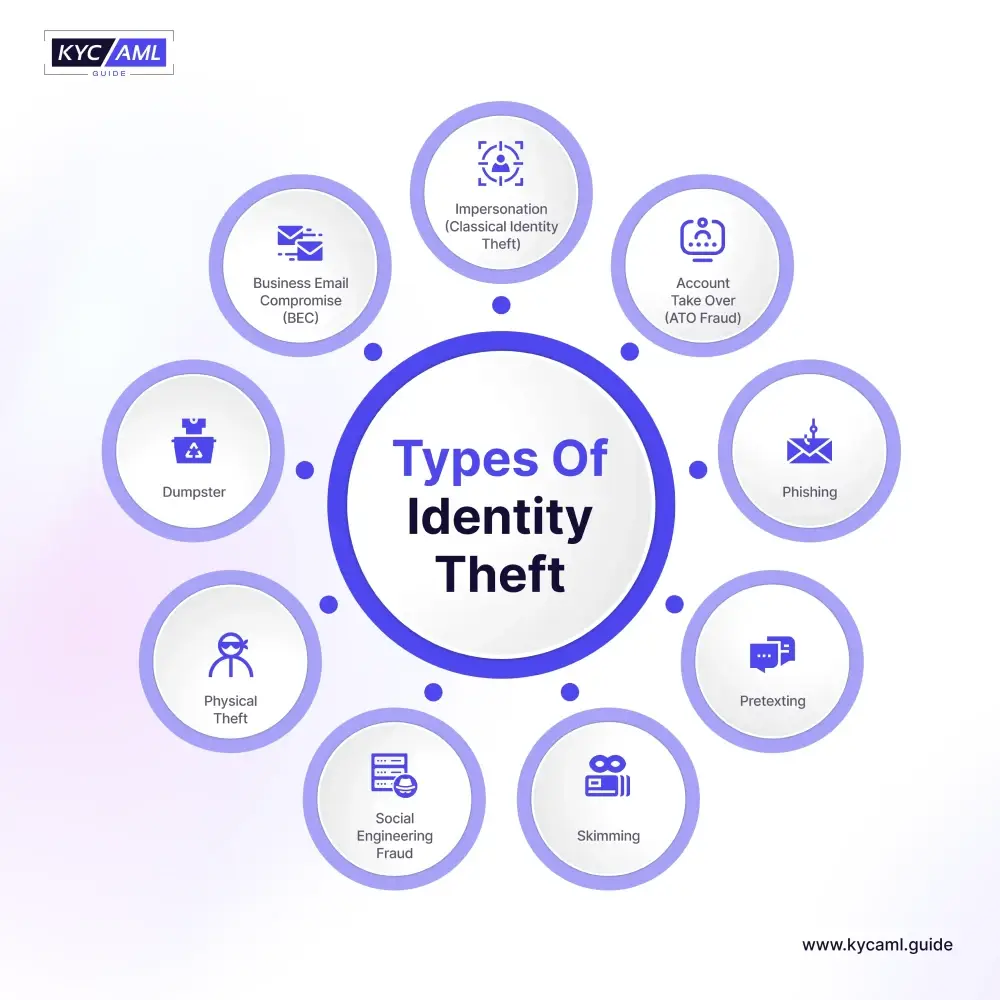

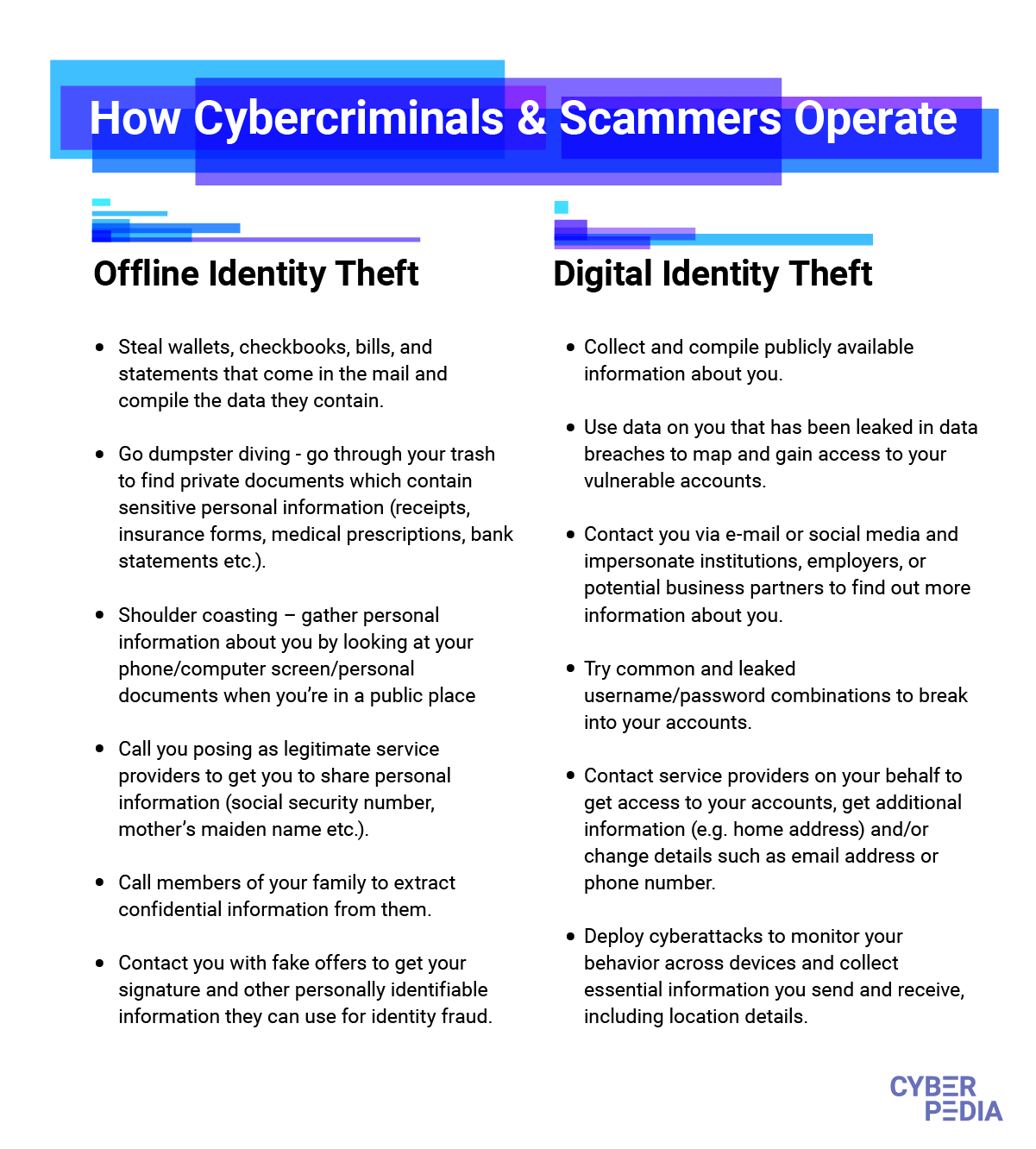

Identity Theft and Impersonation scams occur when criminals steal someone’s personal details—such as name, date of birth, bank account information, or government ID numbers—and use them for fraudulent activities. With this stolen information, scammers can open bank accounts, apply for loans, make online purchases, or even impersonate the victim in communication with others. In the digital age, where so much of our information is stored and shared online, these scams have become alarmingly common.

The impact goes far beyond financial loss. Victims of identity theft often deal with long-term damage to their credit score, legal complications, and emotional distress from having their identity misused. In impersonation scams, fraudsters may pretend to be trusted individuals, such as company executives, family members, or government officials, to trick people into transferring money or giving away confidential data.

How It Works

Identity theft usually begins with the collection of personal data. This can happen through phishing emails, fake websites, hacked databases, or stolen physical documents. Once in possession of the data, scammers use it to conduct illegal transactions. For example, they may apply for loans in the victim’s name, leaving the person in debt without their knowledge. Others may use stolen credit card details for large purchases, often reselling goods for quick cash.

Impersonation scams take this a step further. Fraudsters may pose as trusted individuals or organizations—such as sending emails that look like they came from a victim’s boss, bank, or government agency. In personal cases, scammers may impersonate family members on WhatsApp or social media, claiming to be in urgent need of money. Many people fall victim because the request seems urgent and comes from someone they know and trust.

Some of the most dangerous forms of impersonation involve synthetic identity theft, where criminals combine real and fake information to create entirely new identities. These synthetic identities are then used to commit fraud on a larger scale, often going undetected for long periods.

Identity theft is one of the fastest-growing crimes worldwide. According to reports, millions of people fall victim each year, with billions of dollars lost globally. In the United States alone, the Federal Trade Commission (FTC) receives hundreds of thousands of identity theft complaints annually, covering issues from fake credit card applications to medical identity theft.

Businesses also face heavy losses when scammers impersonate executives or employees in Business Email Compromise (BEC) schemes, costing companies billions in damages yearly. For individuals, recovery is slow and stressful, often requiring months or even years to clear false records and restore financial stability.

We Will Be Useful to You

At Jitte Rex Tech, we help victims of identity theft and impersonation scams recover stolen funds, dispute fraudulent charges, and restore their digital security. Our forensic specialists trace the origin of data breaches, track fraudulent accounts, and provide expert support in resolving credit disputes.

We also help businesses protect themselves from impersonation attacks by implementing stronger email security, employee training, and monitoring systems that can detect suspicious activities before they cause damage.

👉 If your identity has been stolen or someone is impersonating you online or offline, contact us immediately. Our experts can help you regain control and protect your financial and personal security.

Account Takeovers

Account Takeover (ATO) scams happen when fraudsters gain unauthorized access to a victim’s online accounts—such as email, banking, social media, or e-commerce accounts—and use them for fraudulent activities. These attacks often begin with stolen login details obtained through phishing, data breaches, malware, or weak passwords. Once inside the account, scammers can lock the rightful owner out, steal funds, impersonate the victim, or use the account to spread scams to others.

The danger of account takeovers is that they often go unnoticed at first. Victims may not realize their account has been compromised until they see unauthorized transactions, unusual login notifications, or complaints from contacts who received fraudulent messages. Beyond financial losses, account takeovers damage reputations, erode trust, and expose victims to further identity theft.

How It Works

Account takeovers typically begin when cybercriminals obtain login credentials. This may happen through phishing emails that trick users into entering their passwords, fake login portals designed to steal credentials, or malware that records keystrokes. In some cases, scammers purchase usernames and passwords from the dark web, where data from previous breaches is sold in bulk.

Once they gain access, the attackers often change recovery settings—such as linked emails, phone numbers, and security questions—making it difficult for the rightful owner to regain control. They may then drain bank accounts, make purchases with stored cards, or use compromised social media accounts to promote scams. For businesses, attackers can hijack employee accounts to launch Business Email Compromise (BEC) attacks or steal confidential data.

In many cases, account takeovers are part of a wider fraud network. For example, a hacked email account can be used to reset passwords on other linked accounts, creating a chain reaction of compromised access. This method allows criminals to expand their control across multiple platforms with a single stolen credential.

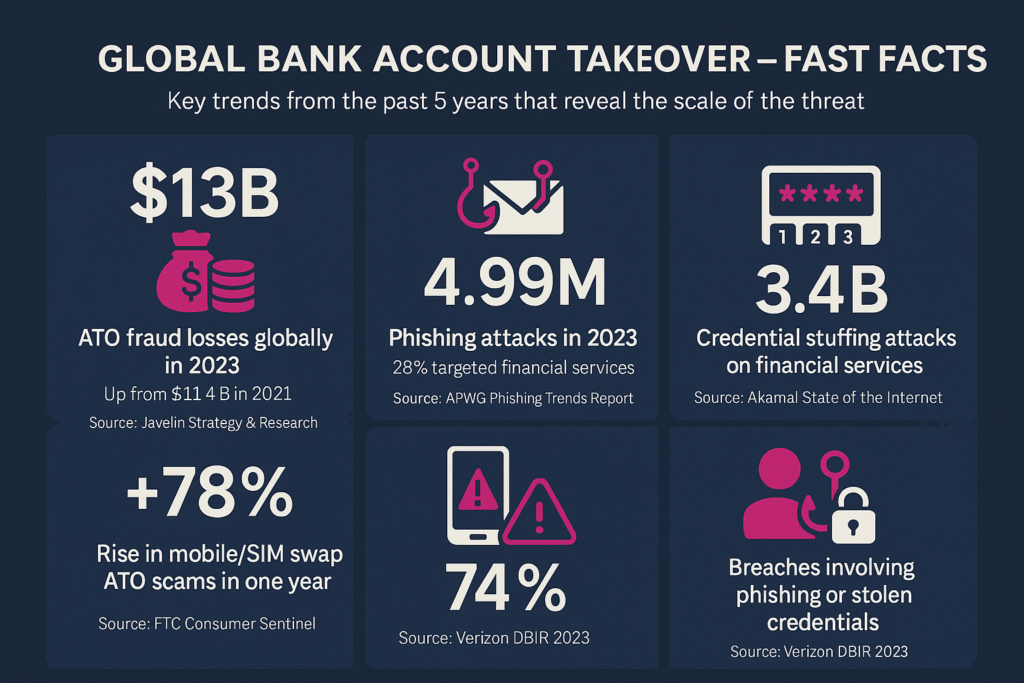

Account Takeover fraud is one of the fastest-growing cybercrimes worldwide. Reports show that billions of login credentials are exposed in data breaches every year, and cybercriminals actively test these details against online platforms. According to industry data, account takeover attacks cost businesses over $10 billion annually, with banks, e-commerce platforms, and social media companies among the hardest hit.

For individuals, the cost is not only financial but also emotional. Victims often deal with frozen accounts, drained savings, damaged credit, and lost trust from friends or clients who may have been targeted through impersonation. Recovering from an account takeover can take weeks or even months, depending on the severity of the attack.

We Will Be Useful to You

At Jitte Rex Tech, we specialize in detecting, investigating, and reversing account takeover attacks. Our team can trace unauthorized access, restore control of compromised accounts, and recover financial losses where possible. We also assist victims in strengthening their online security to prevent future attacks, including guidance on multi-factor authentication, password management, and monitoring for suspicious activities.

For businesses, we provide comprehensive protection strategies to secure customer accounts, prevent large-scale breaches, and reduce the financial impact of fraud.

👉 If your accounts have been hacked, locked, or used without your permission, contact us today. Our experts will help you recover access and safeguard your online presence from further attacks.

Fake Tech Support Scams

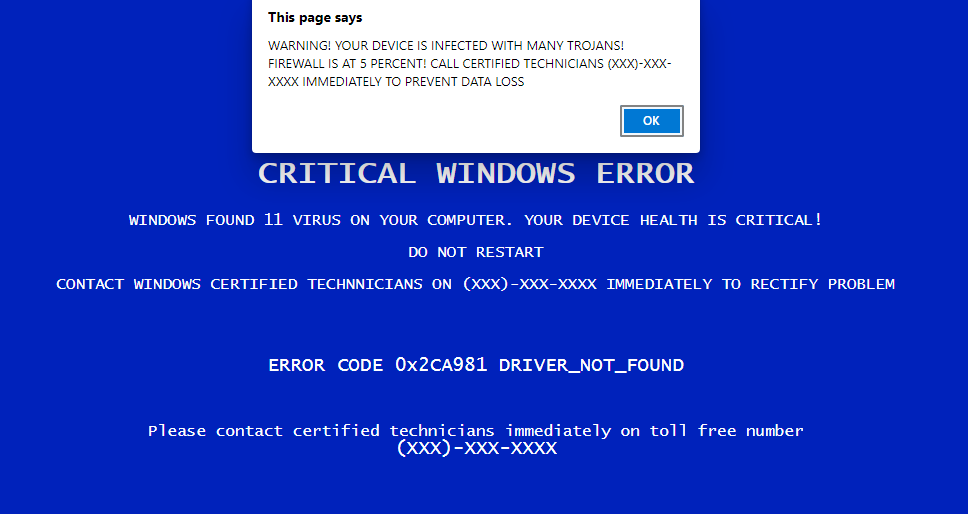

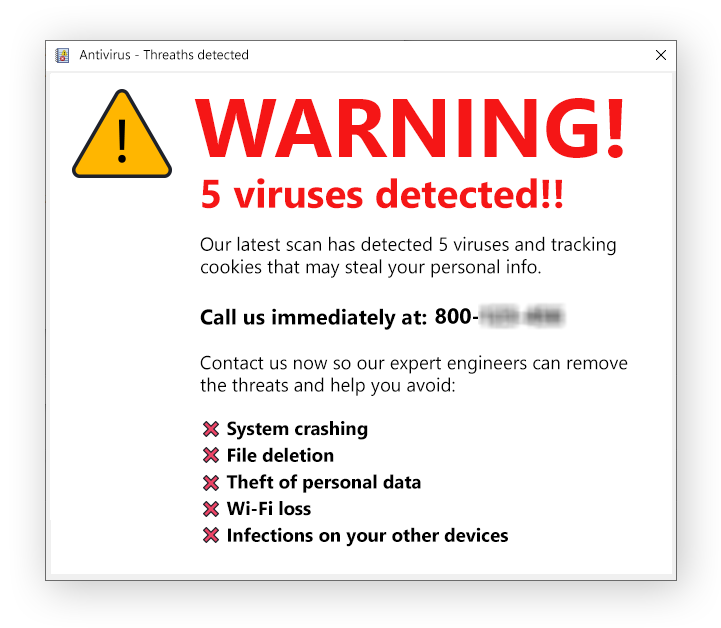

Fake Tech Support Scams are a widespread type of fraud where scammers pretend to be technical support representatives from trusted companies like Microsoft, Apple, or well-known antivirus providers. Their main goal is to convince victims that their devices have serious problems—such as viruses, malware, or unauthorized access—and then pressure them into paying for unnecessary services or granting remote access to their devices.

These scams often start with alarming pop-up messages, fake warning emails, or unsolicited phone calls claiming that your computer has been compromised. Once the victim panics, the fraudsters step in as “helpful experts,” offering a quick solution—for a fee. But instead of solving a problem, they either install harmful software, steal personal and financial information, or trick the victim into recurring charges for fake subscriptions.

How It Works

The typical scam begins when a victim receives a pop-up alert on their device. These warnings often claim: “Your computer is infected—call Microsoft immediately at this number.” In other cases, scammers send phishing emails that look like official company messages. Some even cold-call unsuspecting people, pretending to be technicians running “security checks.”

When victims respond, the fraudsters ask them to install remote access software so they can “fix” the issue. This gives the scammers full control of the device. Once inside, they may:

Pretend to run diagnostic scans that show fake results.

Demand payment for software or services that do not exist.

Steal sensitive data like banking logins, emails, and ID information.

Install ransomware or spyware to cause further damage.

For businesses, these scams can be even more dangerous. If employees fall for them, criminals can gain access to company servers, sensitive documents, and customer data. This opens the door to identity theft, financial fraud, and large-scale security breaches.

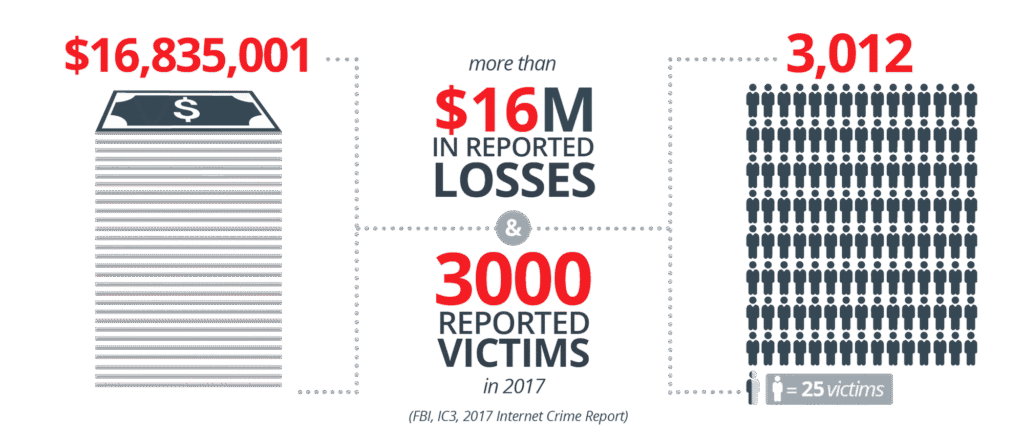

According to global fraud reports, tech support scams account for hundreds of millions of dollars in annual losses, with older adults being the most frequent targets. In the U.S. alone, the FBI’s Internet Crime Complaint Center (IC3) receives thousands of reports yearly, with losses exceeding $800 million in recent years.

What makes these scams so effective is fear and urgency. Victims feel pressured to act quickly to prevent supposed damage to their device, making them less likely to question whether the call, email, or pop-up is real. Unfortunately, once money is transferred or access is granted, recovery becomes much harder.

We Will Be Useful to You

At Jitte Rex Tech, we specialize in identifying, reversing, and preventing fake tech support scams. If you have already paid money, installed software, or given remote access to someone claiming to be “tech support,” we can help trace the fraud, recover your funds where possible, and secure your devices.

We also provide educational resources and prevention strategies, teaching both individuals and companies how to recognize fake alerts, verify real support contacts, and block scam attempts before they cause harm.

👉 If you’ve been tricked by a fake tech support scam or suspect your computer has been compromised, contact us immediately. Our experts will help you recover, secure your data, and protect your future online safety.

Social Media Scams

Social Media Scams have become one of the fastest-growing forms of online fraud. With billions of people using platforms like Facebook, Instagram, Twitter (X), TikTok, and LinkedIn, scammers have found endless opportunities to trick users. These scams can appear as fake investment opportunities, impersonated accounts, fraudulent giveaways, phishing links, or even emotional manipulation through direct messages.

The rise of digital communication has made it easier than ever for criminals to hide behind fake profiles, stolen photos, and convincing stories. Victims are often lured by the familiarity of social platforms—they feel like they’re engaging with friends, influencers, or trusted brands. But behind the screen, fraudsters are waiting to exploit trust, curiosity, and sometimes desperation for financial gain.

How It Works

Social media scams come in many forms, but they often share one thing in common: they exploit trust and urgency. For example, scammers may create fake celebrity or brand pages promoting unbelievable giveaways such as “Win an iPhone, just click this link!” Others may impersonate a victim’s friend or relative, asking for urgent financial help.

Another common trick involves fraudulent investment pitches, particularly in cryptocurrency or forex trading, where victims are shown fake profit screenshots and pressured into depositing money into bogus platforms. Some scammers also send phishing links disguised as login pages, tricking users into entering their credentials, which are later used for account takeovers.

For businesses, the risks are even higher. Criminals often clone company pages, run fake ads, or impersonate customer service representatives to steal sensitive information from clients. This not only causes financial harm but can also damage the brand’s reputation.

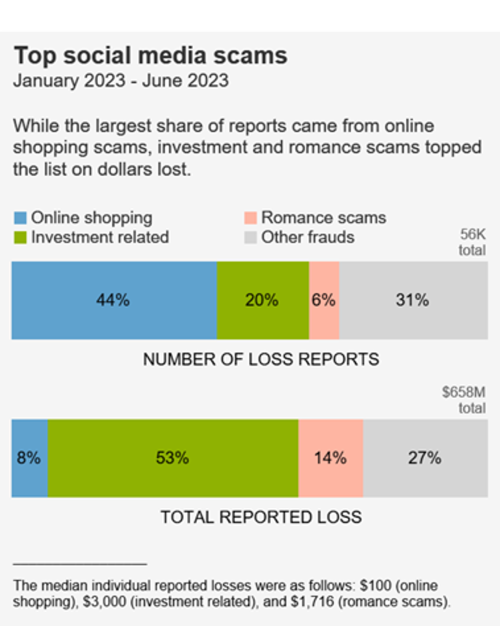

According to global cybercrime reports, social media scams account for over $1 billion in annual losses worldwide. In the U.S., the Federal Trade Commission (FTC) revealed that in recent years, more than one in four fraud reports involved scams that started on social media.

The most targeted age group is surprisingly young adults (18–35), who spend the most time online and are more likely to engage with new accounts, giveaways, and investment pitches. However, no age group is completely safe—scammers design their approaches to appeal to anyone, from young professionals to retirees.

We Will Be Useful to You

At Jitte Rex Tech, we help victims of social media scams trace fraudulent activities, recover stolen funds, and secure their accounts. Whether you lost money to a fake investment group, gave sensitive information to an impersonator, or had your account taken over, our experts provide step-by-step recovery and security solutions.

We also work with businesses to detect fraudulent brand impersonations, report fake accounts, and develop preventive measures to safeguard their online presence.

👉 If you have fallen victim to a social media scam—or suspect a fake account is trying to trick you—contact us immediately. We will help you recover, secure your digital identity, and stay protected against future threats.

Lottery & Prize Scams

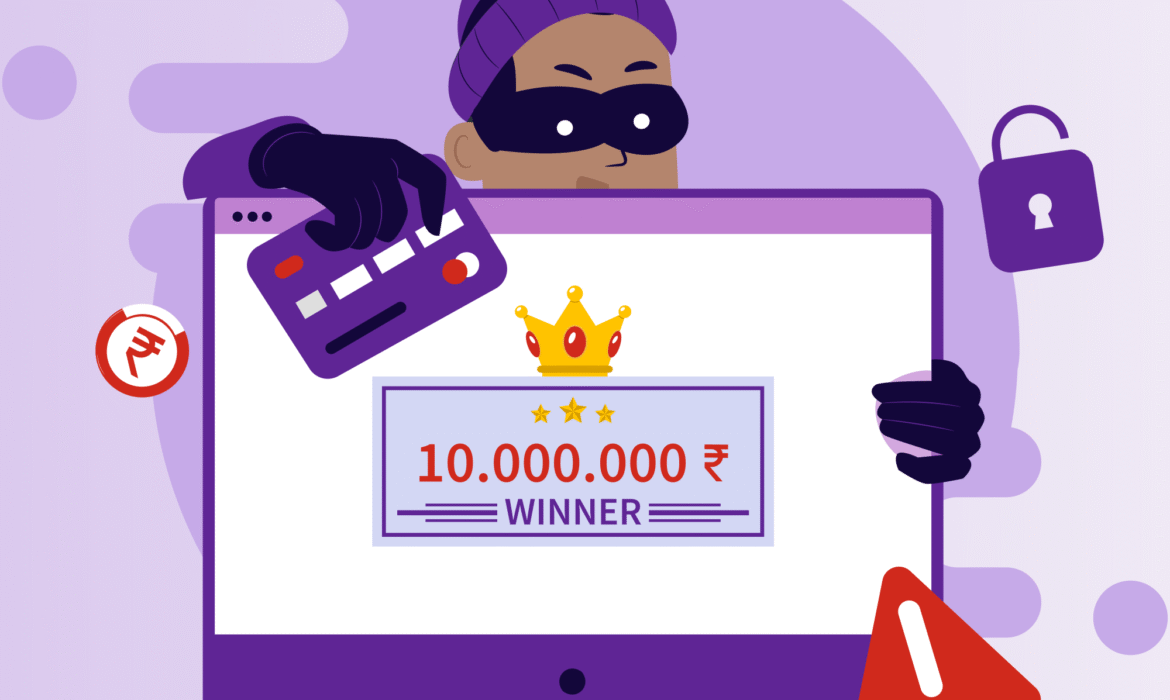

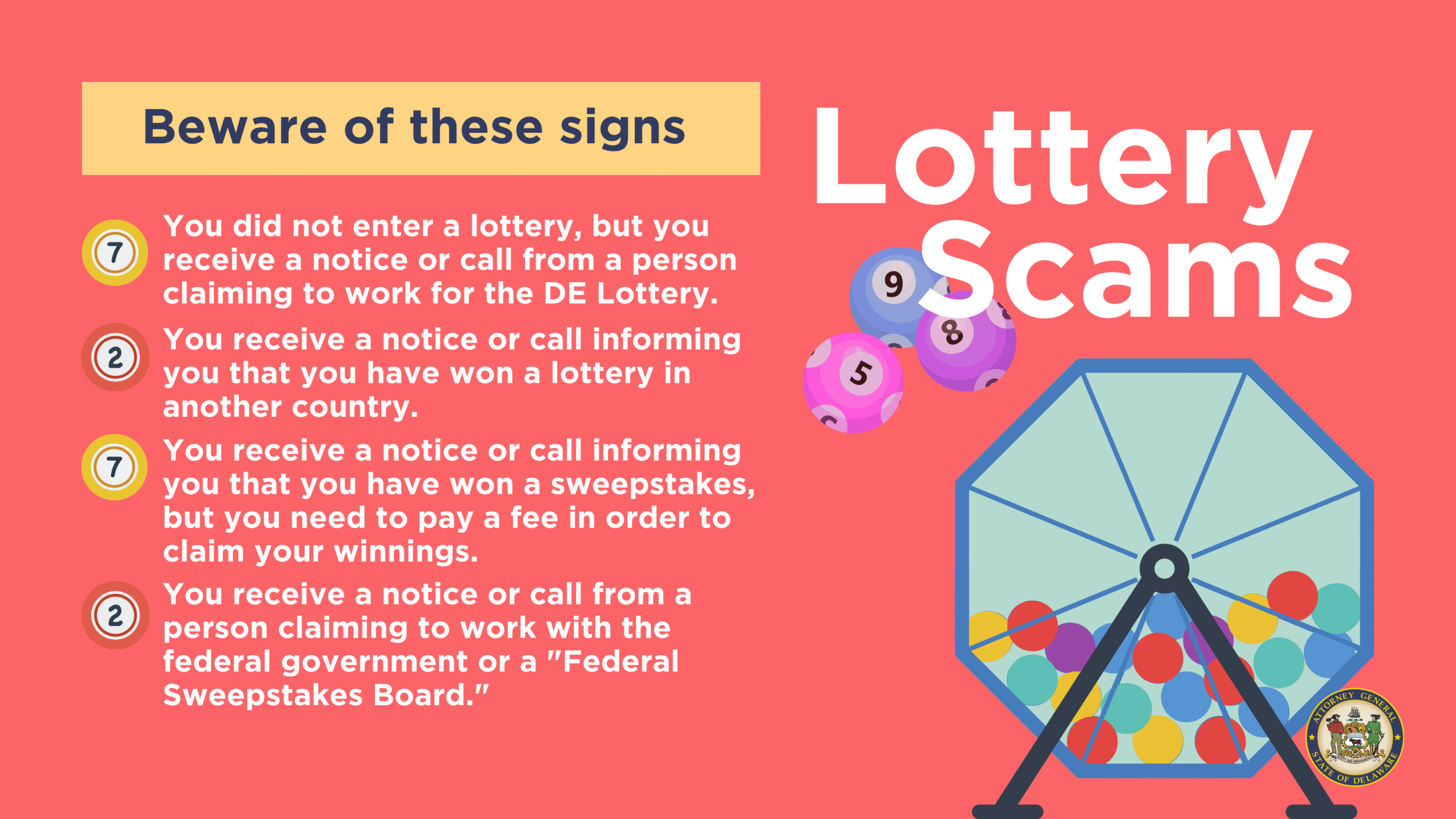

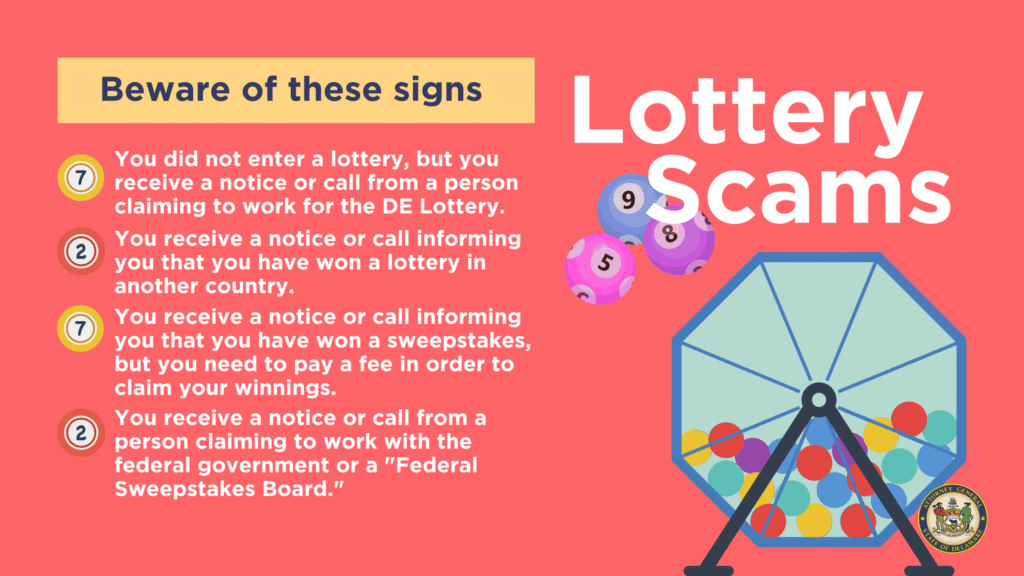

Lottery and Prize Scams are one of the oldest but still highly effective forms of online fraud. They usually begin with a message, email, phone call, or even a social media DM claiming that the victim has “won a lottery, sweepstake, or grand prize”. The catch? Victims are told they must pay certain fees, taxes, or processing charges before they can claim their winnings.

The scam works so well because it preys on human excitement and hope. Even people who never entered a lottery can easily get tricked when presented with “official-looking” documents, congratulatory messages, or false assurances that they’ve won big. Fraudsters use the names of real organizations, government bodies, or famous brands to add credibility, making the victim believe the prize is genuine.

How It Works

Lottery and prize scams often start small but can escalate quickly. Victims receive emails with subject lines like “Congratulations! You are our lucky winner” or social media messages that announce surprise winnings. These messages are carefully crafted to look professional, often using stolen logos, forged signatures, and legal-sounding language.

Once the victim responds, scammers request “processing fees”, “delivery costs”, or “government taxes” to release the prize. Some even go further by asking for sensitive information like passports, bank details, or ID cards—leading to identity theft in addition to financial loss.

A more advanced version involves fake lottery agents who claim to represent international sweepstakes. They may ask the victim to keep the “win” confidential for “security reasons,” isolating them from family or friends who could have warned them. By the time victims realize there was never a prize, they may have lost thousands of dollars to multiple staged requests.

Globally, lottery and prize scams cost victims hundreds of millions of dollars every year. The U.S. Federal Trade Commission (FTC) reports that older adults, especially those over 55, are among the most targeted age groups because they are more likely to trust official-looking communications.

In many cases, scammers operate from international networks, making it difficult for victims to track them down or seek direct refunds. Still, forensic tracing and collaboration with financial institutions can help recover stolen funds and prevent further exploitation.

We Will Be Useful to You

At Jitte Rex Tech, we specialize in investigating and exposing lottery and prize scams. Our experts work with victims to trace fraudulent transactions, recover lost money, and report scam operations to the relevant authorities, including the FBI and international cybercrime units.

Whether you received a fake email, paid “fees” for a prize that never arrived, or had your personal identity misused, we provide professional assistance to help you recover and secure your future.

👉 If you have been targeted by a lottery or prize scam, don’t stay silent. Contact us today—our team will stand by you, recover what you’ve lost, and ensure you never fall victim again.

Romance & Dating Scams

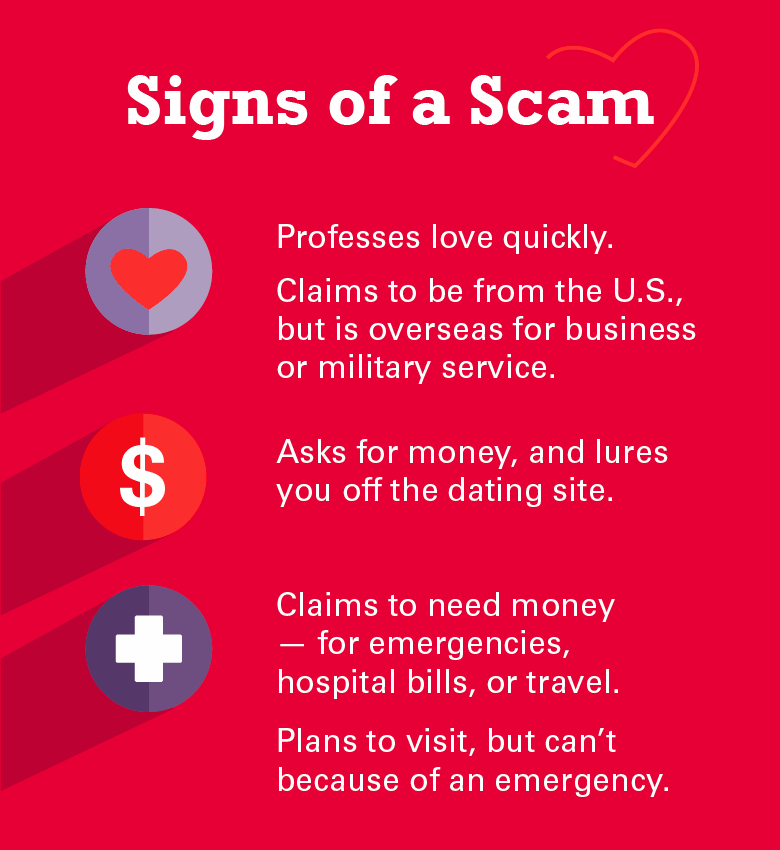

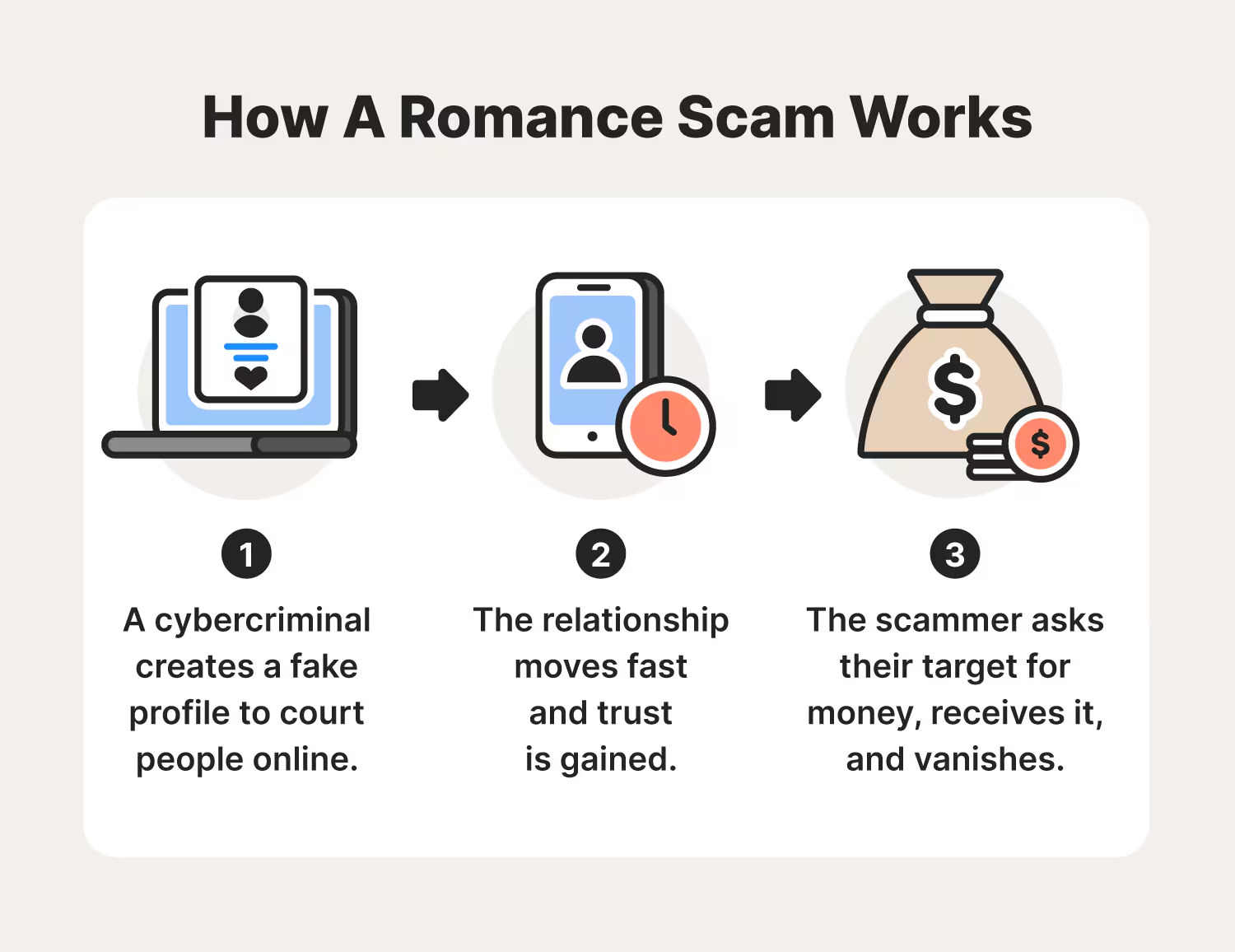

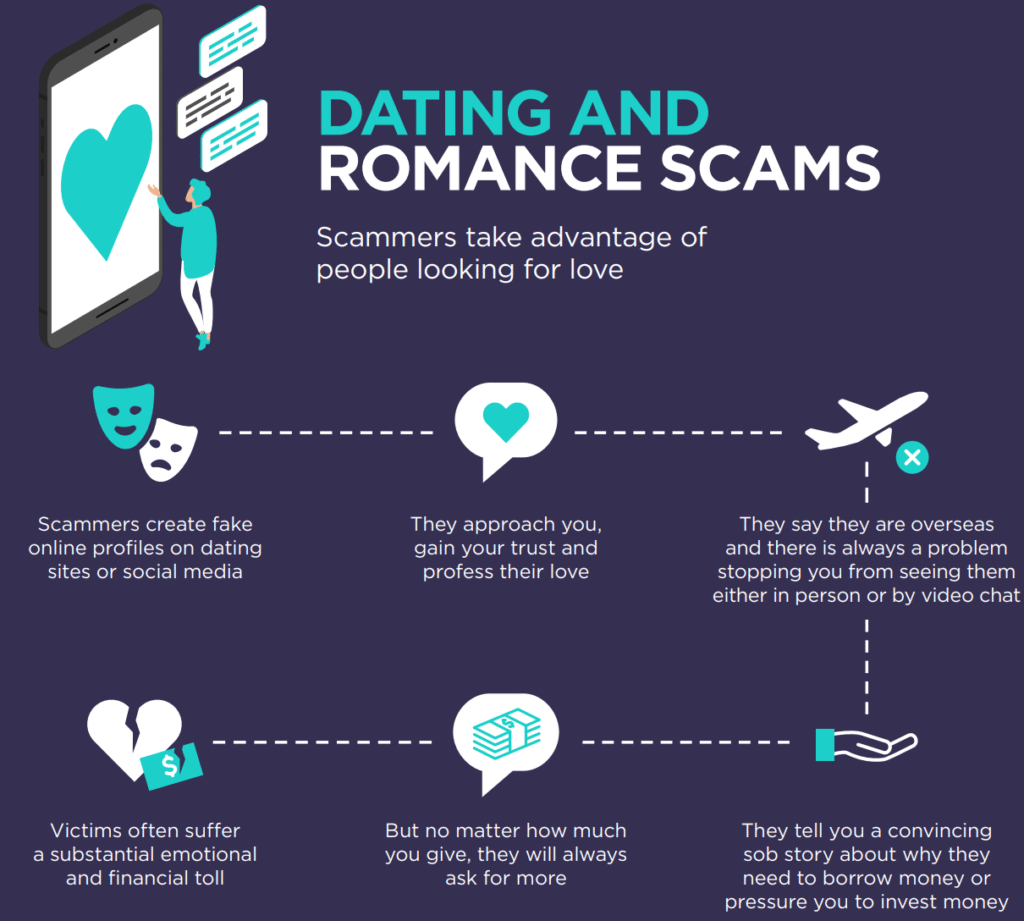

Romance and Dating Scams are among the most emotionally devastating types of fraud. Unlike scams that rely on quick deception, romance scams are carefully crafted over weeks or even months. Scammers pretend to be loving, caring partners on dating sites, apps, or even social media. They build trust, share fake stories, and make victims believe they are in a genuine relationship.

Once an emotional bond is established, the fraudster introduces financial requests. These could range from emergency medical bills, visa applications, or “investment opportunities” to even helping with travel costs so they can finally “meet in person.” By the time the victim realizes it was all a lie, they may have lost not only large sums of money but also their trust in genuine relationships.

How It Works

Romance scams often begin innocently: a stranger sends a friend request, compliments the victim, or starts a casual conversation. They usually present themselves as professionals working abroad—soldiers, doctors, engineers, or businesspeople. This “long-distance” excuse is key because it explains why they cannot meet in person right away.

The scammer then carefully nurtures emotional intimacy. They send sweet messages, share fake photos, and even stage phone or video calls using stolen identities. Once the victim is fully convinced of the relationship, requests for money begin. The reasons always sound urgent and believable:

“I need help with a hospital emergency.”

“My account is frozen, can you send me funds temporarily?”

“I want to travel to meet you, but I need support for visa fees.”

Some romance scams overlap with investment scams where the scammer convinces the victim to invest in crypto, forex, or other fake platforms “as a couple.” This way, love and financial trust are both exploited, leading to massive losses.

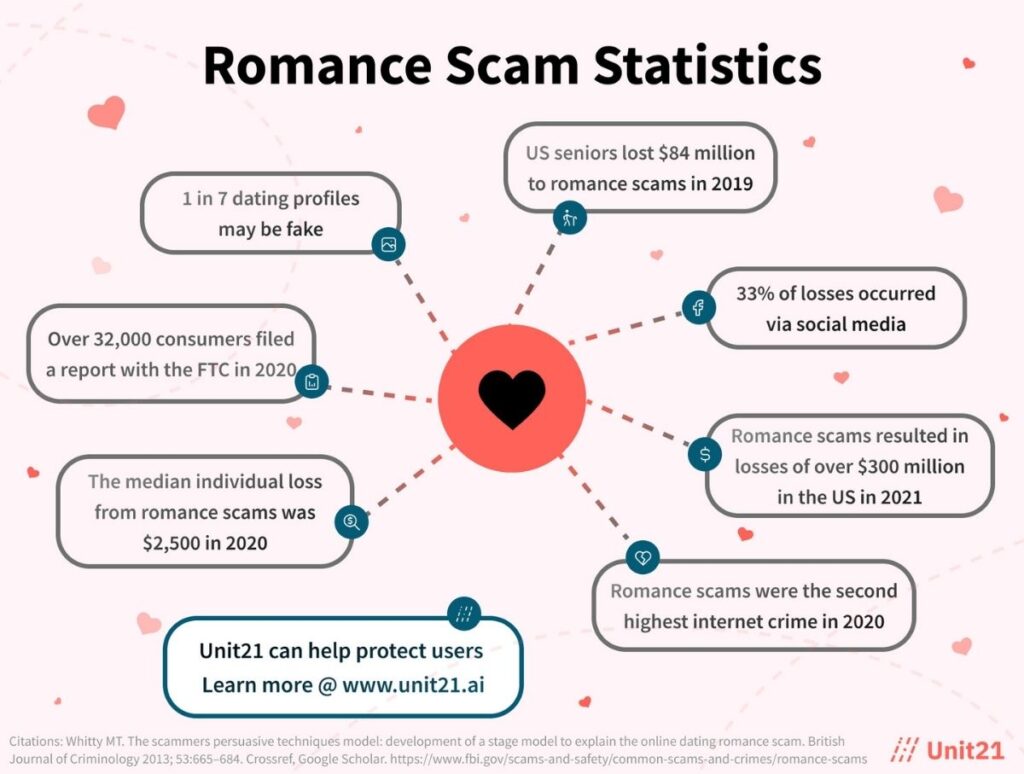

Romance scams are one of the fastest-growing categories of fraud globally. According to the FTC, victims in the United States alone lost over $1.3 billion in 2022 to romance scams, making it one of the highest reported scam types.

The emotional manipulation makes these scams especially damaging. Victims are often too ashamed or heartbroken to report the crime, giving scammers more freedom to continue preying on others. Women and men alike are targeted, though older adults and widows/widowers are at particularly high risk.

We Will Be Useful to You

At Jitte Rex Tech, we understand that romance scams don’t just take money—they shatter trust and leave deep emotional wounds. Our role goes beyond financial recovery. We help victims trace fraudulent accounts, recover stolen funds, and expose criminal networks behind these scams.

If you have ever sent money to someone you thought you were in love with, or if you suspect your online partner may not be genuine, don’t wait until it’s too late.

👉 Contact us today if you have been scammed in a romance or dating scheme. We will help you recover your losses, protect your accounts, and give you the confidence to move forward.

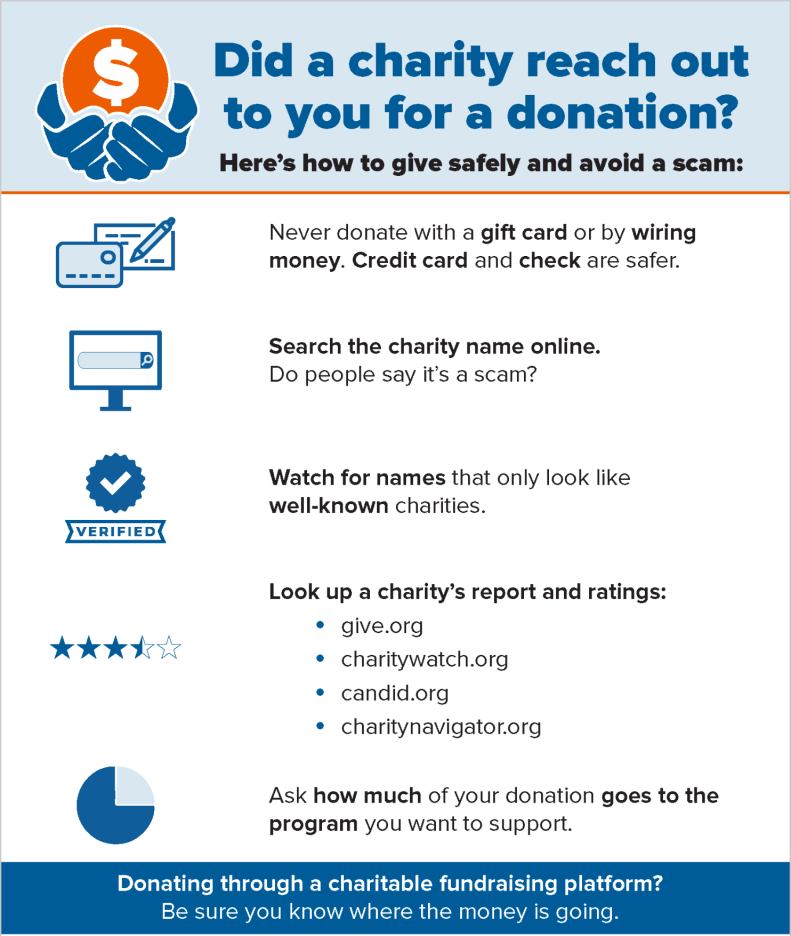

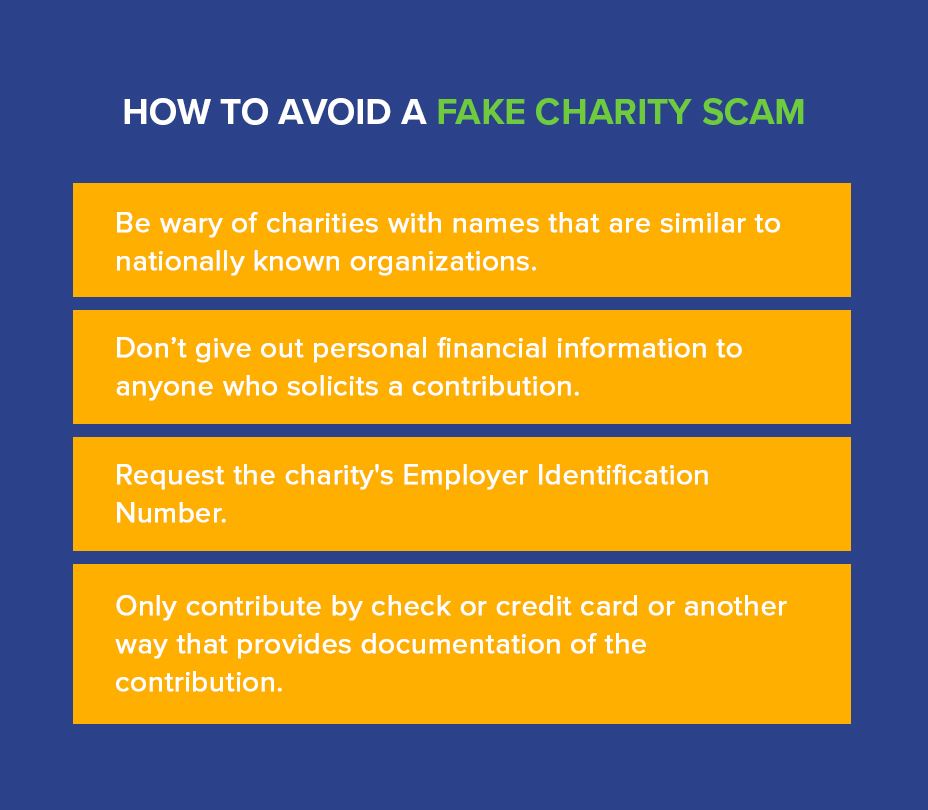

Charity & Donation Scams

Charity and Donation Scams prey on people’s kindness and generosity. Whenever there is a natural disaster, humanitarian crisis, pandemic, or social cause trending online, scammers set up fake charities or impersonate legitimate ones. They create emotional stories, touching images, and even professional-looking websites to trick people into donating money that never reaches those in need.

These scams exploit one of humanity’s best traits—the willingness to help others. Victims believe they are making a difference, but instead, their contributions end up in the pockets of fraudsters. Sadly, this not only drains personal finances but also diverts much-needed support away from real victims and genuine charities.

How It Works

Charity scams usually follow a simple but effective pattern. Fraudsters exploit current events—such as earthquakes, floods, wars, or health emergencies—by launching urgent donation appeals. They often use social media ads, fake websites, phishing emails, or even phone calls. The message is always emotional:

“Children are starving, please help today.”

“Your donation can save lives in this crisis.”

“We are raising funds for urgent medical supplies.”

Scammers sometimes go further by impersonating well-known NGOs, religious organizations, or government agencies. They copy logos, create fake receipts, and assure donors that their funds are tax-deductible. To increase urgency, they often pressure people to donate immediately, usually via untraceable payment methods such as gift cards, cryptocurrency, or direct wire transfers.

Unlike other scams where victims may realize quickly, charity scams often go unnoticed for years. People donate in good faith, never realizing that their generosity was exploited.

Globally, billions of dollars are lost annually to fraudulent charities. For example, after major disasters, reports of fake fundraising campaigns spike within days. According to the Federal Trade Commission (FTC), fake charities consistently rank among the top reported fraud categories in the United States.

The impact is twofold: not only do individuals lose money, but genuine charities also lose credibility and critical funding. This reduces trust in legitimate humanitarian work, ultimately harming those who truly need support.

We Will Be Useful to You

At Jitte Rex Tech, we specialize in investigating fraudulent donation platforms and tracing where stolen contributions go. Our forensic analysts can identify fake websites, expose impersonators, and work on recovering lost funds. We also provide awareness training to help donors distinguish between genuine and fraudulent fundraising campaigns.

If you’ve ever donated to a cause online and later suspected it wasn’t real, or if you want to confirm whether a charity request is legitimate, we can help.

👉 Contact us today if you have been scammed by a fake charity or donation appeal. We’ll help you trace your funds, secure your accounts, and ensure your future contributions make a real difference.

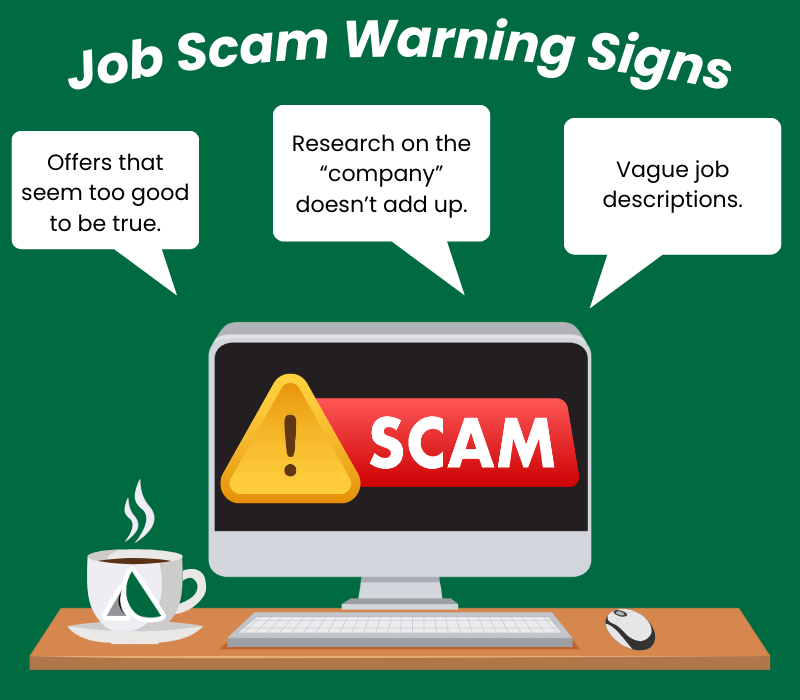

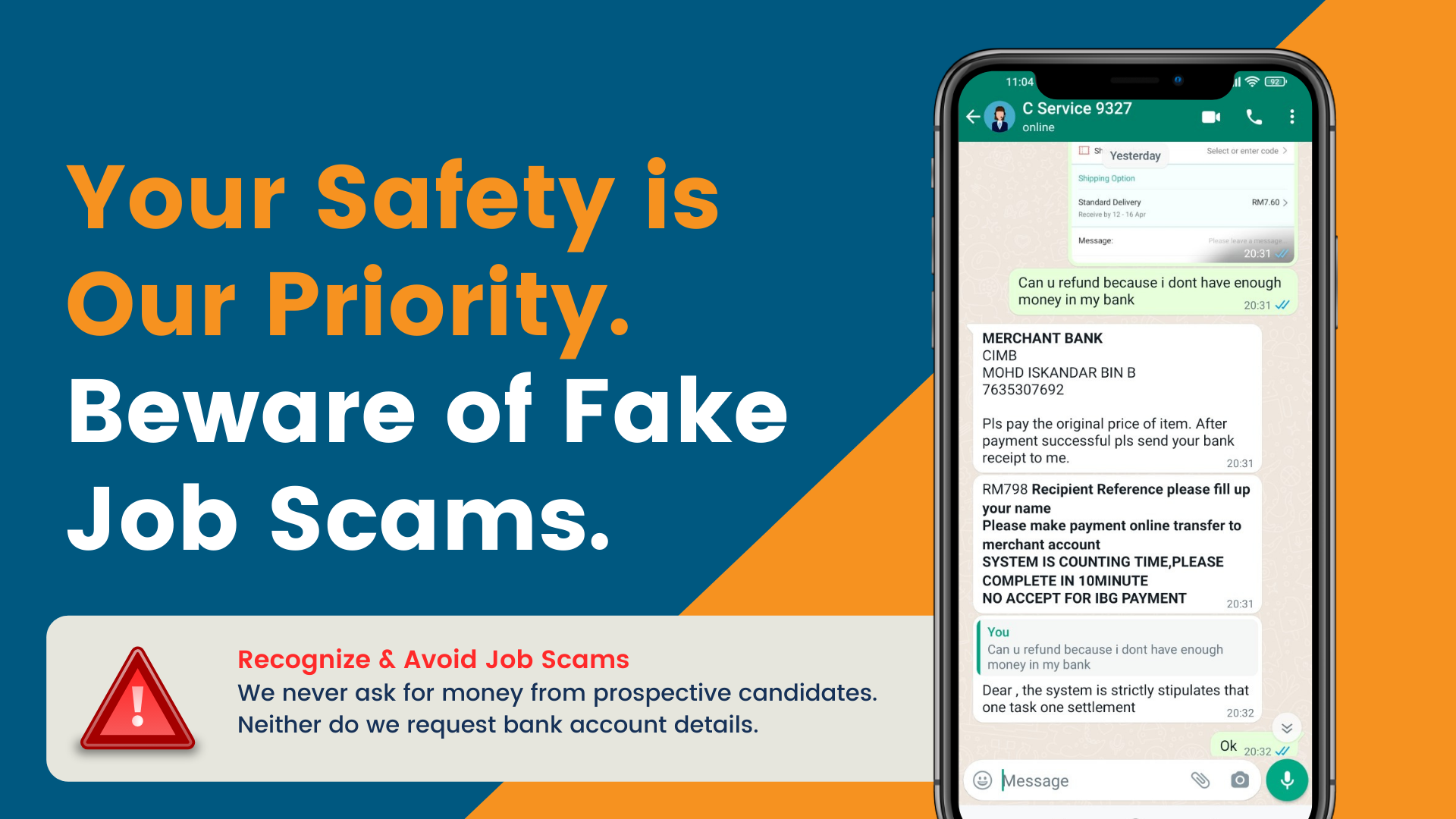

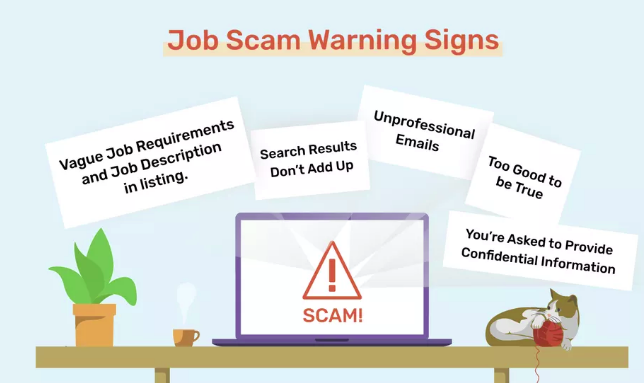

Job & Employment Scams

Job and Employment Scams target people who are actively looking for work or extra income. With the rise of online job boards, remote work opportunities, and social media platforms, scammers have found endless ways to exploit desperate job seekers. They create fake job postings, impersonate real companies, or offer “too good to be true” positions that promise high pay with little effort.

The emotional trap is simple: people searching for work are often stressed, vulnerable, and eager to secure employment. Scammers use this vulnerability to their advantage, luring victims into sending personal documents, paying upfront “training” or “application” fees, or even unknowingly becoming money mules for criminal organizations. Instead of starting a new career, victims are left financially drained, embarrassed, and sometimes entangled in serious legal issues.

How It Works

These scams often begin with professional-looking job ads posted on legitimate sites or through unsolicited emails and direct messages on LinkedIn, Telegram, or WhatsApp. The offers usually sound attractive: flexible hours, remote work, no prior experience needed, and high pay. Some common tactics include:

Fake recruitment agencies that demand “processing fees” or visa payments.

Fraudsters impersonating big companies, asking candidates to submit personal data for “background checks.”

Work-from-home scams where victims unknowingly launder money or process stolen goods.

Offers requiring victims to buy expensive training materials or software upfront.

The scammers always push for urgency: “Positions are limited,” or “Act fast to secure your spot.” Many victims don’t realize they’ve been deceived until the money is gone, or they are ghosted after making payments.

According to the Better Business Bureau (BBB) and Federal Trade Commission (FTC), job scams are one of the fastest-growing categories of online fraud. In the U.S. alone, victims reported over $840 million lost to fake employment opportunities in 2023, with losses continuing to rise as more people seek online or remote work.

Beyond financial losses, these scams often lead to identity theft, since job seekers submit CVs, IDs, bank account details, and even tax records during the fake application process. Some victims unknowingly participate in money laundering schemes, facing severe consequences from banks and law enforcement.

We Will Be Useful to You

At Jitte Rex Tech, we help victims of employment scams trace fraudulent recruiters, secure stolen personal information, and recover lost funds where possible. Our team also educates job seekers on spotting red flags—like recruiters who demand payment, unverifiable companies, and suspicious communication practices.

If you’ve paid money for a job that never existed, submitted sensitive documents to a fraudulent recruiter, or suspect an employment offer may be fake, we can investigate and take immediate action to protect you.

👉 Contact us today if you’ve been scammed by a fake job or recruiter. We’ll help you uncover the fraud, recover your losses, and safeguard your identity.

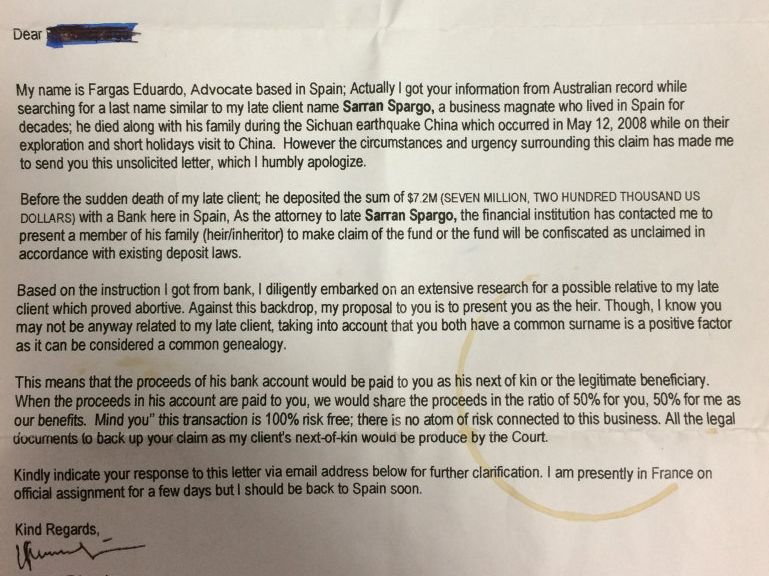

Lottery & Inheritance Scams

Lottery and Inheritance Scams are among the oldest but still highly effective forms of fraud. They prey on people’s hopes of sudden wealth and their belief in good fortune. Victims are told they’ve won a large cash prize in a lottery they never entered, or that they are entitled to an inheritance from a distant relative they’ve never heard of. These scams are designed to shock, excite, and confuse, pushing victims to act quickly without questioning the legitimacy of the claim.

The hook is simple but powerful: the promise of life-changing money. Once the victim believes the story, scammers invent excuses to demand payments for “processing fees,” “taxes,” or “legal documents” before the prize or inheritance can be released. By the time victims realize it’s a scam, they may have lost thousands of dollars, their personal details, and in some cases, even their trust in legitimate financial institutions.

How It Works

These scams usually arrive via email, text message, postal mail, or even phone calls. The messages often carry official-looking logos, stamps, or legal language to appear authentic. Victims are told they have won millions in an international lottery, or they are named as heirs to a wealthy estate overseas. To claim the money, they are instructed to:

Pay administrative or courier fees before funds can be “released.”

Provide sensitive documents like passports, bank details, or tax IDs.

Communicate with fake lawyers or officials who reinforce the lie.

Keep the matter “confidential” to avoid questions from loved ones.

Some scams go even further, using forged court documents or bank letters to make the scheme look legitimate. Victims can get caught in endless cycles of sending money for one fake “requirement” after another, while the promised prize or inheritance never materializes.

According to the Federal Trade Commission (FTC), lottery and sweepstakes scams cost victims in the U.S. alone over $200 million annually, with older adults being the most frequent targets. Inheritance scams, while less common, are often more costly—individual victims have lost tens of thousands to hundreds of thousands of dollars after being convinced they were heirs to estates abroad.

The psychological impact is also devastating. Many victims feel ashamed for believing the scam, and some continue to hope the money is real even after being warned, which makes intervention difficult.

We Will Be Useful to You

At Jitte Rex Tech, we specialize in uncovering fraudulent prize and inheritance schemes. Our experts trace fake documents, identify the fraudsters behind suspicious claims, and help victims recover funds where possible. Beyond recovery, we also provide education to ensure people never fall victim again to these manipulative tactics.

If you have been promised lottery winnings, inheritance funds, or any sudden wealth that requires you to pay money upfront—stop immediately. Legitimate prizes and inheritances do not require fees to be released.

👉 Contact us today if you’ve been scammed by fake lottery winnings or inheritance claims. We will investigate, protect your identity, and work towards recovering your losses.