Identity Theft & Impersonation

Identity Theft and Impersonation scams occur when criminals steal someone’s personal details—such as name, date of birth, bank account information, or government ID numbers—and use them for fraudulent activities. With this stolen information, scammers can open bank accounts, apply for loans, make online purchases, or even impersonate the victim in communication with others. In the digital age, where so much of our information is stored and shared online, these scams have become alarmingly common.

The impact goes far beyond financial loss. Victims of identity theft often deal with long-term damage to their credit score, legal complications, and emotional distress from having their identity misused. In impersonation scams, fraudsters may pretend to be trusted individuals, such as company executives, family members, or government officials, to trick people into transferring money or giving away confidential data.

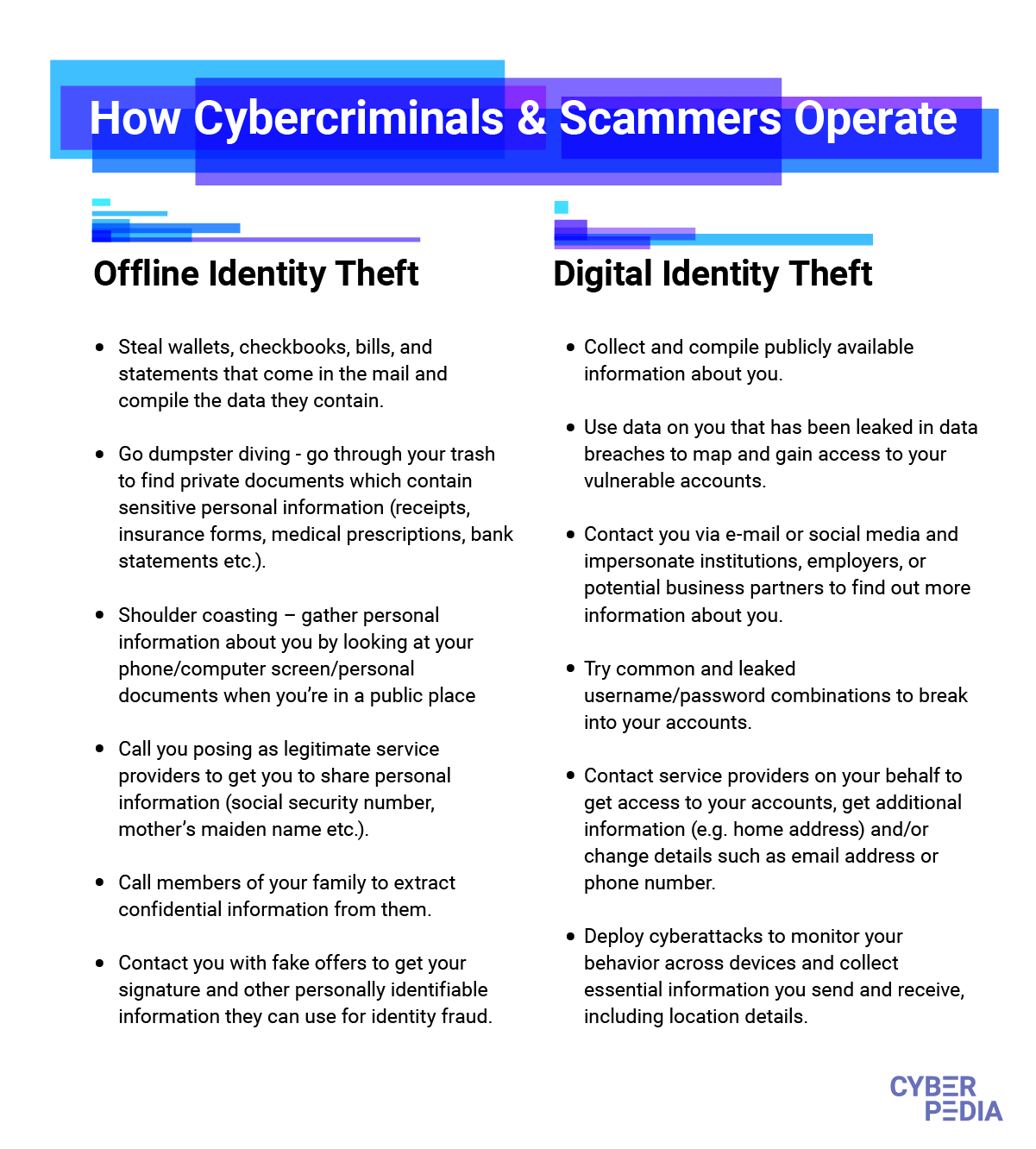

How It Works

Identity theft usually begins with the collection of personal data. This can happen through phishing emails, fake websites, hacked databases, or stolen physical documents. Once in possession of the data, scammers use it to conduct illegal transactions. For example, they may apply for loans in the victim’s name, leaving the person in debt without their knowledge. Others may use stolen credit card details for large purchases, often reselling goods for quick cash.

Impersonation scams take this a step further. Fraudsters may pose as trusted individuals or organizations—such as sending emails that look like they came from a victim’s boss, bank, or government agency. In personal cases, scammers may impersonate family members on WhatsApp or social media, claiming to be in urgent need of money. Many people fall victim because the request seems urgent and comes from someone they know and trust.

Some of the most dangerous forms of impersonation involve synthetic identity theft, where criminals combine real and fake information to create entirely new identities. These synthetic identities are then used to commit fraud on a larger scale, often going undetected for long periods.

Identity theft is one of the fastest-growing crimes worldwide. According to reports, millions of people fall victim each year, with billions of dollars lost globally. In the United States alone, the Federal Trade Commission (FTC) receives hundreds of thousands of identity theft complaints annually, covering issues from fake credit card applications to medical identity theft.

Businesses also face heavy losses when scammers impersonate executives or employees in Business Email Compromise (BEC) schemes, costing companies billions in damages yearly. For individuals, recovery is slow and stressful, often requiring months or even years to clear false records and restore financial stability.

We Will Be Useful to You

At Jitte Rex Tech, we help victims of identity theft and impersonation scams recover stolen funds, dispute fraudulent charges, and restore their digital security. Our forensic specialists trace the origin of data breaches, track fraudulent accounts, and provide expert support in resolving credit disputes.

We also help businesses protect themselves from impersonation attacks by implementing stronger email security, employee training, and monitoring systems that can detect suspicious activities before they cause damage.

👉 If your identity has been stolen or someone is impersonating you online or offline, contact us immediately. Our experts can help you regain control and protect your financial and personal security.