Cryptocurrency Scams

Cryptocurrency has opened new doors for people all over the world. It has changed how we save, invest, and even send money. But with all these opportunities also comes a darker side. Crypto scams are everywhere today, and they are getting smarter each year.

These scams are not just random; they are carefully planned and designed to make you trust before they take everything from you.

How It Works

Cryptocurrency scams have grown into one of the most dangerous traps in today’s digital world. They target people from every background — whether beginners exploring digital currency for the first time or experienced investors looking for bigger opportunities. The way these scams work is often very strategic. It usually begins with a false sense of trust. Victims are lured through flashy advertisements, fake celebrity endorsements, or even direct messages that promise high returns in a short time.

The websites and platforms created by these fraudsters look professional and convincing. They display fake trading charts, profit dashboards, and even provide quick “support” responses to keep the victim confident. At first, when a person invests a small amount, they may even see fake profits showing on their account screen. This illusion encourages them to invest more, sometimes thousands of dollars, believing they are multiplying their wealth.

But the real shock comes at the point of withdrawal. Suddenly, hidden rules appear — victims are told they must pay additional fees, taxes, or make a final “unlock” deposit before they can withdraw. These conditions never end. Once the victim refuses or becomes suspicious, the scammers cut communication, the website disappears, and the money is gone.

Optimization Statistics

The scale of cryptocurrency scams is massive. In 2023 alone, billions of dollars were stolen through fake investment platforms, phishing attacks, and fraudulent recovery schemes. Reports show that more than half of victims delay reporting their case because of fear or shame, which gives scammers even more time to vanish with the funds.

The most worrying part is that many victims fall again for a second type of fraud — recovery scams. Here, fake agents claim they can retrieve stolen money for an upfront fee, only to disappear again. This double loss has left thousands hopeless and unwilling to trust any form of assistance.

What makes these scams successful is not just their technical setup but their emotional manipulation. They use greed, urgency, and trust to trap their targets. By the time a victim realizes what has happened, the damage is already deep.

From the designers and engineers who are creating the next generation of web and mobile experiences, to anyone putting a website together for the first time. We provide elegant solutions that set new standards for online publishing.

We Will Be Useful to You

If you have fallen victim to a cryptocurrency scam, know this: you are not alone. These crimes are widespread, and thousands of others have experienced the same pain. The key is not to remain silent or give up. Every case carries clues — blockchain trails, fake domains, and transaction records — that can be investigated by professionals.

Our role is to guide you through this process. From the moment you reach out, we carefully assess your case, identify possible recovery paths, and provide honest advice on what can and cannot be achieved. Unlike scammers, we do not make empty promises of instant refunds. Instead, we work with transparency, skill, and the determination to bring you closer to justice.

Stay sharp, stay informed. In crypto, knowledge is your best protection.

✅ Have you been scammed in crypto? Contact us today — our specialists are here to listen and take action on your behalf.

Forex & Stock Trading Scams

Forex and stock trading are supposed to be legitimate avenues for wealth creation, offering individuals the chance to grow their money through financial markets. However, the rise of online platforms and digital advertising has also given scammers the perfect opportunity to exploit unsuspecting traders. These scams usually begin with flashy promises of guaranteed profits, secret trading strategies, or risk-free opportunities that sound too good to be true. The truth is that no legitimate broker or trader can ever guarantee profit in such volatile markets.

What makes these scams especially dangerous is how convincing they look. Fraudsters often design professional websites, create fake mobile apps, and display fabricated dashboards showing steady profits. Victims deposit money believing it is being traded in real markets, only to discover later that the entire system was fake. The real shock often comes when investors try to withdraw their money — at that point, excuses pile up, hidden fees appear, or the platform vanishes entirely.

How It Works

Forex scams often start with flashy advertisements on social media or cold calls from supposed “brokers” promising easy money. They may offer managed accounts where the scammer claims to trade on the victim’s behalf. In reality, no real trading takes place — the deposits are simply pocketed by the fraudster.

Stock trading scams can take the form of “pump and dump” schemes, where scammers artificially inflate the price of a stock by spreading false information, then sell off their shares once the price rises. Ordinary investors who buy into the hype are left holding worthless stocks once the scheme collapses.

Another common trick is the use of fake trading platforms. Victims are shown fabricated charts and balances that make them believe they are earning profits. But the moment they request a withdrawal, the scammers vanish or invent new rules that block access to funds.

Forex and stock scams have evolved with technology. Many now use mobile apps, fake trading bots, and online communities to spread their influence. They often impersonate licensed brokers, complete with forged certificates and cloned websites, making it harder for victims to tell the difference between genuine firms and scammers.

These scams prey on greed, trust, and lack of financial knowledge. By offering quick returns in markets that are already complex and volatile, they lure people who may be new to trading or desperate for financial stability. Unfortunately, by the time victims realize the truth, their savings are already gone.

We Will Be Useful to You

At Jitte Rex Tech, we specialize in helping victims of Forex and stock scams. We analyze fraudulent platforms, trace digital transactions, and work with global authorities — including the FBI and other relevant regulators — to build cases against scammers. Beyond recovery, we also guide our clients on how to identify real investment opportunities and avoid falling into similar traps in the future.

If you have lost money to Forex or stock trading scams, contact us today. Recovery starts with taking the first step.

Ponzi & Pyramid Schemes

From promises of easy wealth to the illusion of financial freedom, Ponzi and Pyramid schemes have trapped millions of people worldwide. They appear attractive on the surface — offering high returns with little effort — but behind the shiny brochures and persuasive words lies nothing more than a cycle of deception. These scams thrive on recruiting new participants to pay old ones, until the entire structure collapses and victims are left with losses.

The interconnectedness of today’s world has made it easier for such schemes to spread, often through social media, WhatsApp groups, or even friends and family who unknowingly become promoters. What makes them dangerous is not just the financial damage but also the broken trust they leave behind. To spot and stop them, we need a clear, informed perspective on how they work.

How It Works

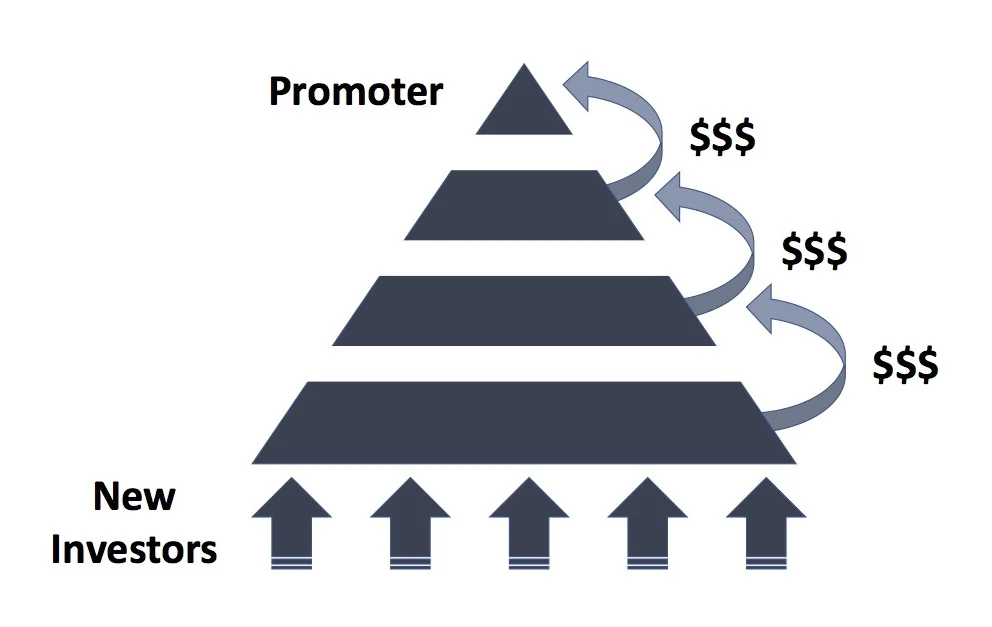

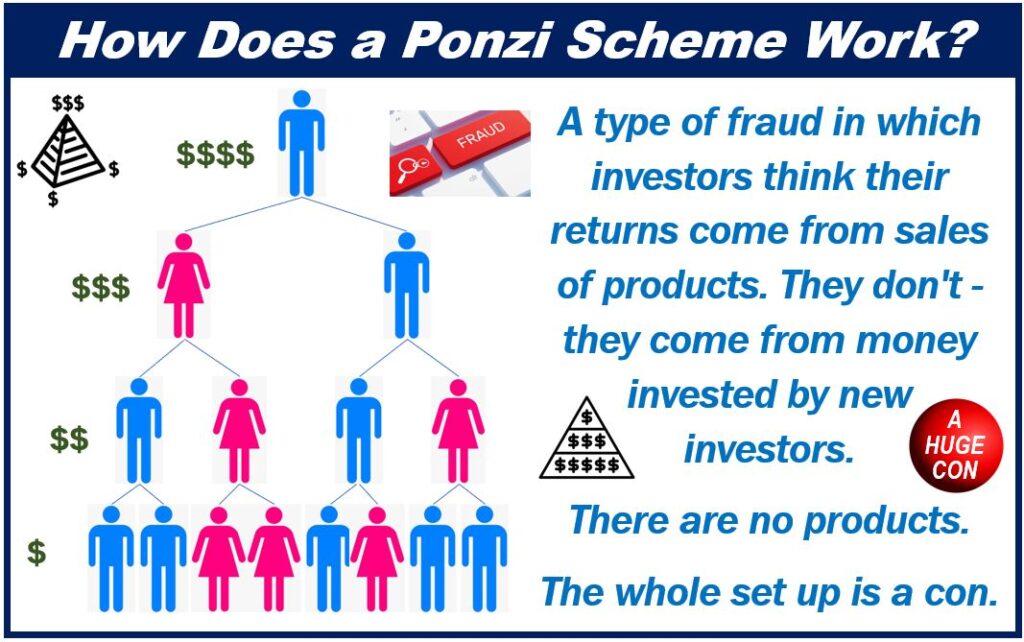

Ponzi schemes usually begin with a convincing story — an investment manager or company that claims to have exclusive access to a money-making strategy. Early participants receive “returns,” not from real profits but from the money paid by new investors. This illusion builds trust and encourages people to reinvest and bring in friends. But as soon as recruitment slows down, the scheme collapses, exposing the fraud.

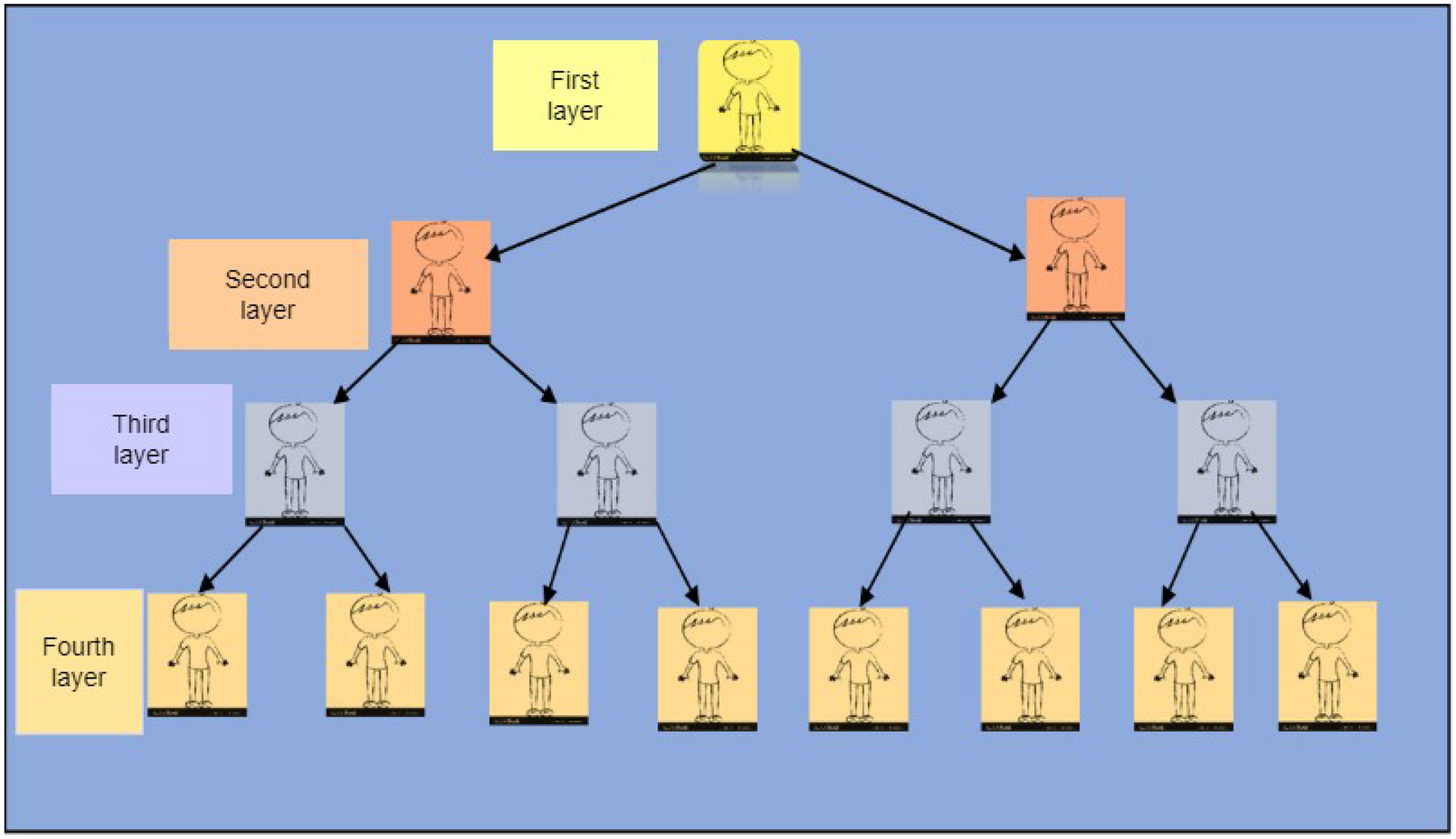

Pyramid schemes, on the other hand, disguise themselves as business opportunities. Participants are told they can earn money by selling products or services, but in reality, the main focus is recruiting others. Each level of recruitment sends money upward to those at the top. Like a house of cards, it cannot last forever — the majority at the bottom lose everything while only a few at the top benefit.

Both scams operate on psychology: the fear of missing out, the promise of exclusivity, and the illusion of community. Victims are often made to feel like insiders in a special opportunity. Sadly, by the time the truth becomes clear, the organizers have vanished, leaving financial and emotional devastation behind.

Over the years, Ponzi and Pyramid schemes have adapted. They now use slick websites, fake dashboards showing “earnings,” and even crypto tokens to look modern and legitimate. Some hide behind MLM (multi-level marketing) models, making it harder for people to distinguish between real businesses and scams.

The danger is not just in the money lost — but in how quickly these schemes spread. Once trust is built within a small community, it snowballs, with victims unintentionally recruiting their friends, family, and colleagues. This ripple effect magnifies the damage and leaves scars that last beyond financial loss.

We Will Be Useful to You

At Jitte Rex Tech, we understand the pain and frustration victims of Ponzi and Pyramid schemes go through. Our role is to investigate the fraudulent networks, track digital footprints, and support victims in pursuing recovery options. We also educate our clients on how to recognize the signs of these scams before they fall victim again.

Digital deception is growing more sophisticated, but so are we. By combining investigation, legal collaboration, and awareness campaigns, we aim to dismantle these schemes and protect future investors.

If you or someone you know has been caught in a Ponzi or Pyramid scheme, contact us today. Your story matters, and with the right support, recovery is possible.

✅ Have you been scammed in crypto? Contact us today — our specialists are here to listen and take action on your behalf.

Fake Online Investment Platforms

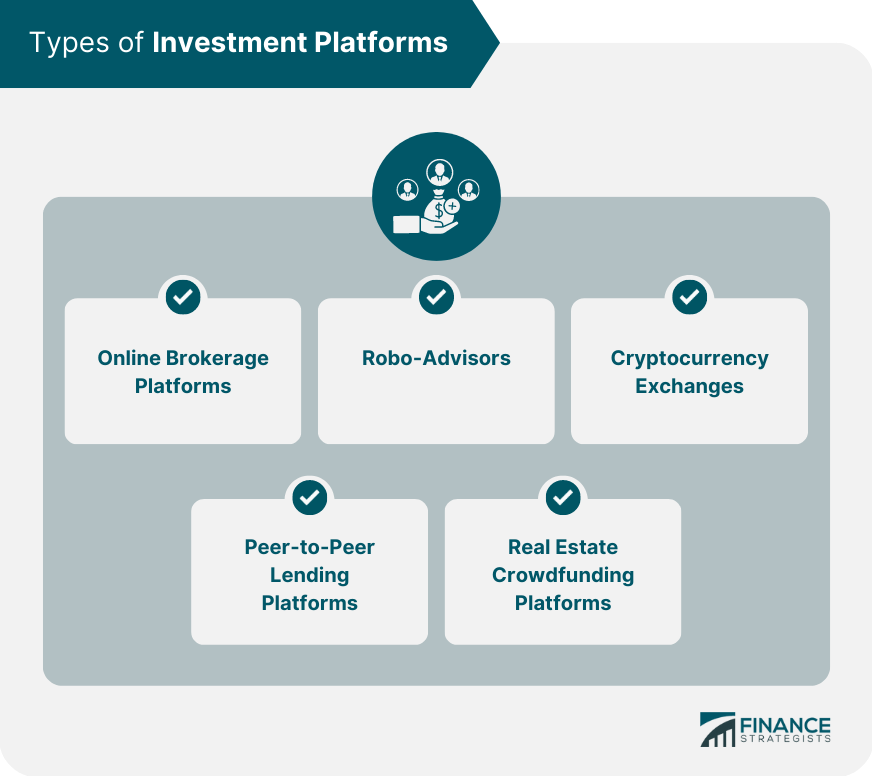

The internet has made investing more accessible than ever before. With just a smartphone or computer, anyone can sign up to a platform and start investing. But this convenience has also opened the door for a new wave of fraud — fake online investment platforms. These scams often look highly professional, complete with sleek websites, live charts, and dashboards showing growing profits. Victims believe they are investing in stocks, crypto, real estate, or other financial products, but in reality, no investment is ever being made. The money goes directly into the pockets of scammers.

What makes these scams especially dangerous is how real they appear. Many platforms use fake licenses, stolen branding from real companies, and even cloned websites of legitimate investment firms. Victims are convinced they are dealing with a trusted company, only to later find out that everything was fabricated. The real trap comes when investors try to withdraw their money. At that point, the platform demands new fees, claims accounts are frozen, or simply disappears without a trace.

How It Works

Fake online investment scams usually start with aggressive marketing campaigns on social media. Ads showcase ordinary people becoming “millionaires overnight” by using the platform. Victims are encouraged to start small, and their dashboards quickly show fake profits to create trust. Once they invest larger amounts, the fraudsters either lock the account or vanish.

Some platforms also offer “investment packages” with fixed returns, such as 20% profit every month. While this sounds attractive, no legitimate investment can guarantee such high, risk-free returns. Others impersonate real companies by using cloned websites that look identical to legitimate brokerages or funds, making it nearly impossible for the untrained eye to spot the difference.

Fake investment platforms have become one of the fastest-growing types of scams globally. Billions of dollars are stolen every year, with victims across every country and age group. The sophistication of these platforms makes them particularly hard to detect, as many integrate real market data, display fabricated trade histories, and even create fake mobile apps.

Some victims report seeing their “investment accounts” grow steadily for months, only to lose everything in a single day when the site vanishes. Others are lured by influencers or paid testimonials, which are part of the scam operation. The emotional toll is equally damaging, as victims not only lose their savings but also suffer shame and fear of speaking up.

We Will Be Useful to You

At Jitte Rex Tech, we specialize in investigating fake investment platforms and exposing the fraud behind them. Our team traces digital transactions, gathers evidence, and collaborates with law enforcement agencies — including the FBI and other international regulators — to assist in recovery efforts.

We know how painful it is to lose hard-earned money to a fake investment scheme. That’s why we provide both recovery services and preventive education, helping clients recognize the red flags of fraudulent platforms before it’s too late.

👉 If you have lost money to a fake online investment platform, contact us immediately. We are here to help you fight back and take the first step toward recovery.

Romance Investment Scams

Romance scams have always been one of the most heartbreaking forms of fraud, but in recent years, scammers have taken them to a new level by combining emotional manipulation with financial deception. This new tactic, known as Romance Investment Scams, is a cruel blend of love and lies. Victims are lured into what they believe is a genuine romantic relationship, only for the scammer to later introduce a “life-changing investment opportunity.” By the time the victim realizes it was never about love, they have often lost large sums of money — sometimes their entire savings.

Unlike traditional romance scams that focus only on emotional exploitation, romance investment scams exploit both the heart and the wallet. Scammers build deep trust with their victims over weeks or even months, using sweet conversations, constant attention, and false promises of a shared future. Once the victim is emotionally dependent, the scammer presents an investment opportunity, usually in cryptocurrency or online trading platforms, claiming it is a safe and easy way to build a future together.

How It Works

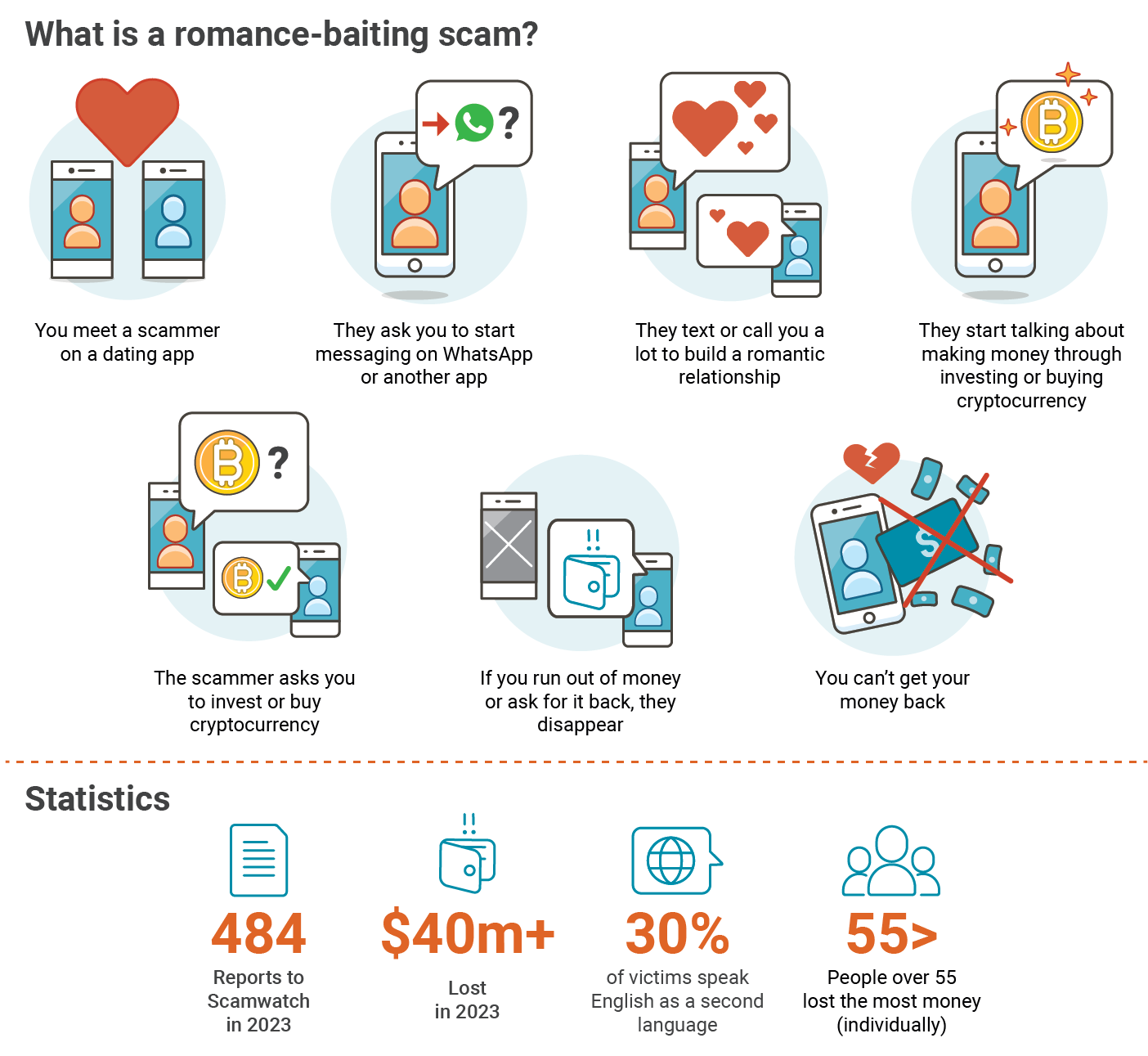

Romance investment scams often begin on dating apps, social media, or even random messages through chat platforms. The scammer plays the role of a caring, supportive partner, sharing daily conversations, pictures, and even fake family details to create a sense of reality. Unlike quick frauds, this type of scam is long-term and carefully planned.

Once the bond is established, the scammer subtly introduces the idea of an investment. They may say things like, “I want us to have a strong future together. I’ve been making money from crypto trading, and I want to share this with you.” Victims are persuaded to join an online platform (which is fake) or send money for “joint investments.” At first, the platform may show profits, reinforcing trust. But when the victim tries to withdraw funds, excuses and complications begin.

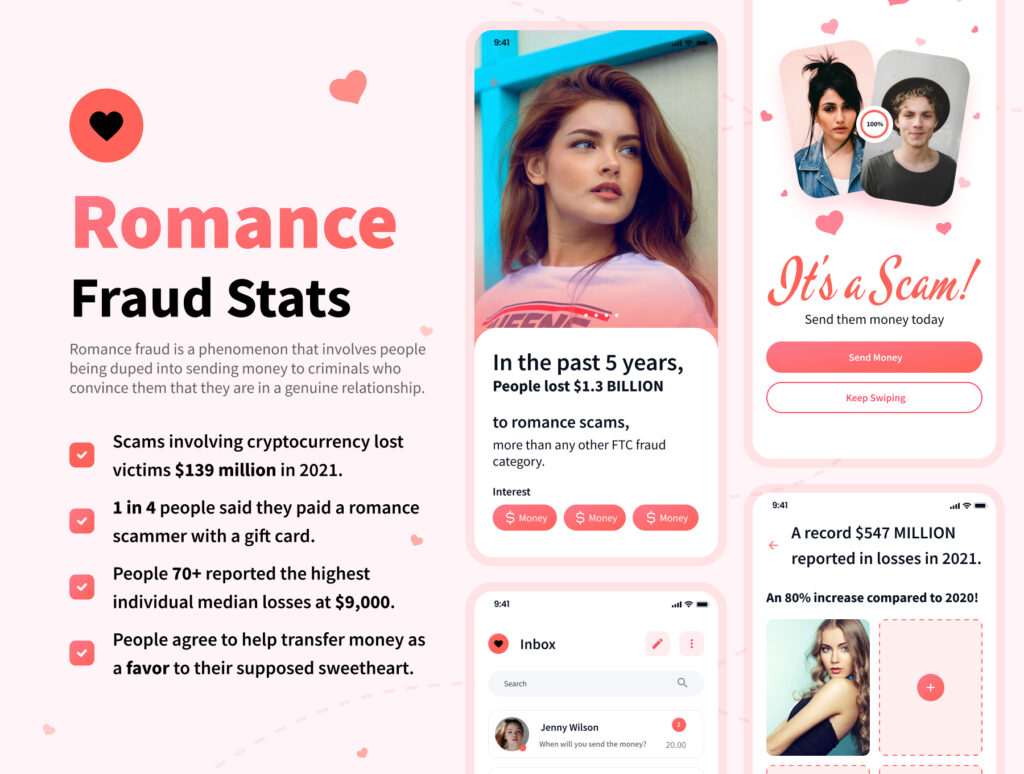

Optimization Statistics

Some scammers even stage fake emergencies, convincing the victim to “invest more” or pay sudden fees. Because the victim believes they are helping someone they love, they often comply without hesitation. This combination of emotional trust and financial manipulation makes romance investment scams one of the hardest to detect and escape.

Romance investment scams are rising at an alarming rate worldwide. According to reports from financial regulators, billions of dollars are lost annually, with many victims unaware until it is too late. The emotional damage is just as severe as the financial loss. Victims not only lose money but also face deep heartbreak, betrayal, and shame. Many hesitate to report the scam because they feel embarrassed for having trusted someone who never truly existed.

These scams are particularly dangerous because they can target anyone — young professionals, widows, retirees, or even highly educated individuals. Love lowers defenses, and when combined with the promise of wealth, it creates the perfect environment for fraud.

We Will Be Useful to You

At Jitte Rex Tech, we understand that romance investment scams are not just financial crimes — they are emotional crimes. Victims often feel isolated, humiliated, and devastated. That is why our approach goes beyond just financial recovery. We also provide support, guidance, and a path to justice.

Our team works with international law enforcement agencies, including the FBI and other national cybercrime authorities, to trace digital footprints, identify fraudulent platforms, and pursue recovery wherever possible. More importantly, we help victims regain confidence and protect themselves from future fraud.

👉 If you have been deceived by someone you trusted in a romance that turned into an investment scam, contact us today. Do not suffer in silence — we can help you take back control.

Online Shopping Scams

Online shopping has made life more convenient than ever before. With just a few clicks, we can buy clothes, gadgets, groceries, or even luxury items from the comfort of our homes. Unfortunately, this convenience has also opened the door for fraudsters to exploit unsuspecting shoppers. Online Shopping Scams are one of the most common forms of cyber fraud today, targeting millions of people across the world every year.

These scams usually involve fake websites, social media ads, or counterfeit stores that look genuine but are designed to steal money or personal information. Victims are tricked into believing they are purchasing legitimate items, but instead, they either receive low-quality counterfeits, nothing at all, or unknowingly hand over their credit card details to criminals. What makes these scams so effective is the level of sophistication — fake stores often have professional-looking designs, product photos, and even fake customer reviews, making them difficult to spot.

How It Works

Online shopping scams take many forms, but most follow a similar pattern. A shopper sees an ad for a heavily discounted product — for example, branded shoes, electronics, or fashion accessories. The prices are deliberately made too good to resist, luring victims into rushing their purchase. Once the payment is made, the story unfolds in several possible ways.

Sometimes, the purchased product never arrives at all, and the website suddenly disappears. In other cases, victims receive a cheap imitation that looks nothing like the advertised item. Worse still, some scams are designed not just to steal money but also to gather personal and banking information for identity theft. Fraudsters may use stolen credit card details for further unauthorized transactions.

Another common trick is subscription scams, where buyers unknowingly agree to recurring charges while believing they are making a one-time purchase. By the time victims realize, their accounts have already been drained by hidden monthly deductions.

According to consumer protection agencies worldwide, online shopping scams rank among the top three most reported cybercrimes annually. Billions of dollars are lost as fraudsters exploit seasonal sales, flash deals, and even festive shopping periods to trick unsuspecting buyers. Fake online shops are particularly active during holidays such as Black Friday, Christmas, and Valentine’s Day when consumers are most eager to find deals.

The damage extends beyond money. Victims often lose trust in online platforms, avoid digital payments, and live with the anxiety of identity theft. For small businesses, these scams also create unfair competition, as fraudsters exploit legitimate brand names to deceive customers.

We Will Be Useful to You

At Jitte Rex Tech, we specialize in exposing and dismantling fraudulent online stores. Our team investigates suspicious domains, traces fraudulent transactions, and works with financial institutions and law enforcement to stop these scams in their tracks. We use advanced forensic tools to recover evidence, identify perpetrators, and where possible, assist victims in retrieving lost funds.

We also provide consumer awareness education, teaching shoppers how to identify red flags such as unrealistic discounts, fake reviews, and unsecured payment gateways. Prevention is just as important as recovery, and our mission is to ensure individuals and businesses stay safe in the digital marketplace.

👉 If you have lost money to a fake online shop or suspicious seller, contact us immediately. The faster you act, the higher the chance of stopping the fraud and recovering your funds.

Phishing & Fake Payment Requests

Phishing remains one of the most dangerous and widespread forms of cybercrime today. It is a deceptive tactic used by criminals to trick individuals or businesses into revealing sensitive information such as passwords, bank details, or credit card numbers. Phishing & Fake Payment Requests are particularly damaging because they are designed to look legitimate, often impersonating trusted companies, banks, or even government agencies.

Fraudsters use carefully crafted emails, text messages, or cloned websites that look almost identical to the real thing. Victims are urged to “verify their account,” “reset a password,” or “confirm a payment.” Once the victim clicks a link or enters their details, the criminals gain direct access to personal and financial accounts. In other cases, fake invoices or payment requests are sent to businesses, pressuring them to make urgent transfers to fraudulent accounts.

How It Works

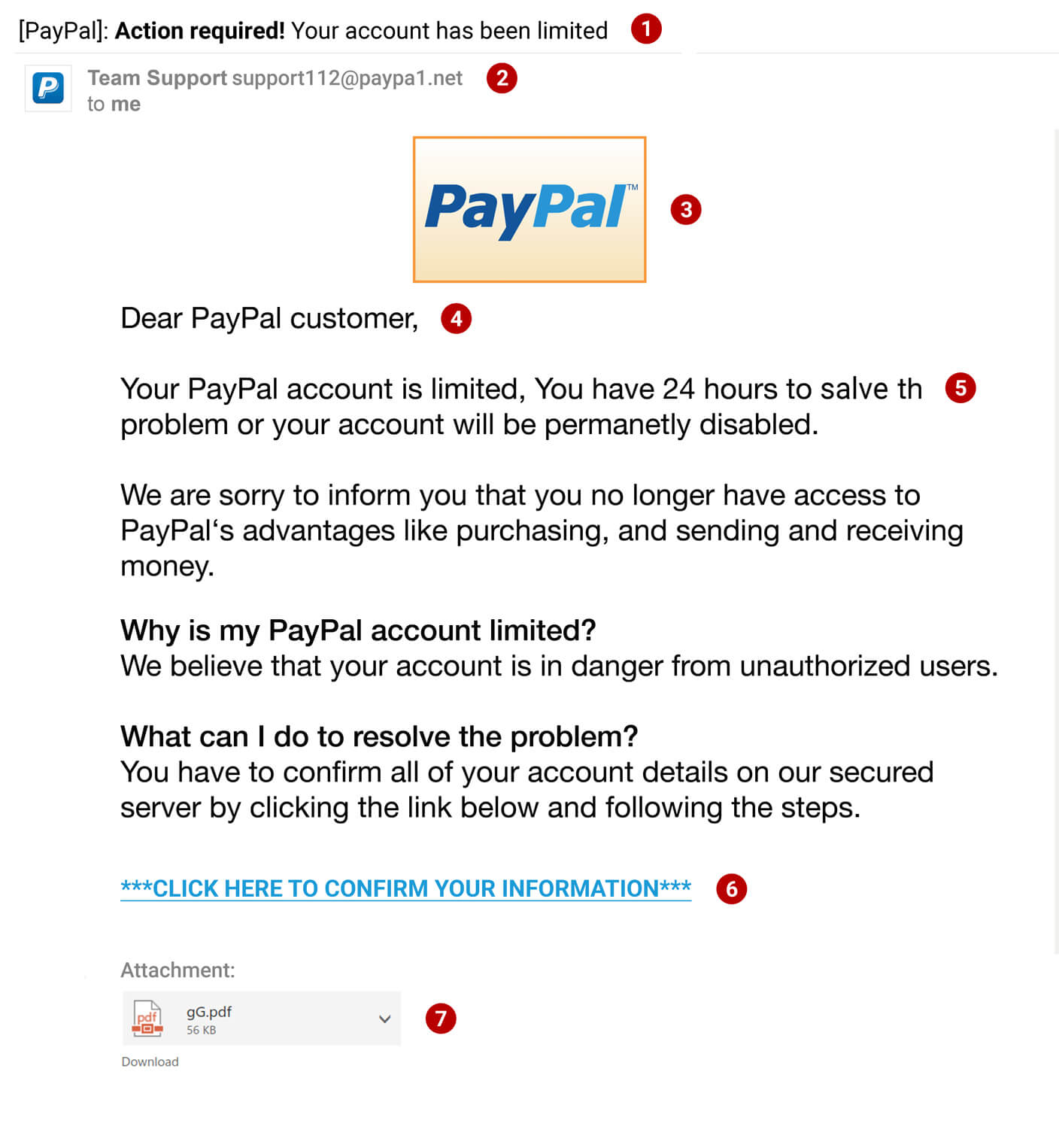

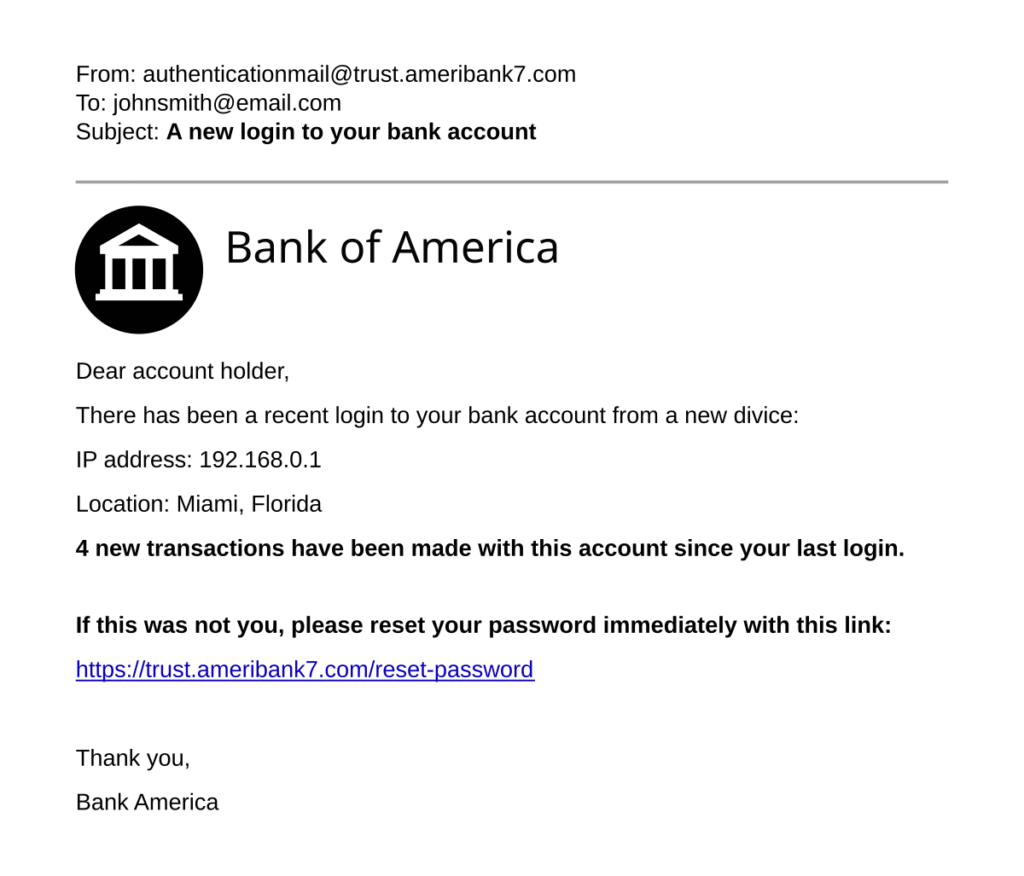

Phishing attacks thrive on urgency and fear. Criminals design their messages to pressure victims into acting quickly, without thinking twice. For individuals, this could be an email from a “bank” claiming that their account will be frozen unless they confirm their details. For businesses, it could be a fraudulent invoice disguised as a regular supplier request.

Fake payment requests have become a serious problem for companies worldwide. Scammers often pose as vendors, clients, or even senior executives within the same company. Through tactics like “Business Email Compromise (BEC),” they send fake payment instructions that look authentic, tricking staff into transferring large sums to offshore accounts.

Sometimes, phishing isn’t just about stealing money directly. It can also involve planting malware or ransomware through links and attachments, allowing fraudsters to infiltrate an entire network. Once inside, they can steal data, lock systems, and demand ransom before restoring access.

Reports from cybersecurity watchdogs reveal that over 3 billion phishing emails are sent daily, making it one of the most common forms of online fraud. Global businesses lose billions annually to fraudulent payment requests, while individuals often lose life savings by unknowingly giving away access to their bank accounts.

Phishing isn’t limited to email. Increasingly, scammers use SMS (smishing) and voice calls (vishing) to target victims. Fake text messages about deliveries, lotteries, or tax refunds have tricked millions of people. Meanwhile, fraudsters posing as customer support agents over the phone continue to con unsuspecting victims into sharing OTPs and account credentials.

We Will Be Useful to You

At Jitte Rex Tech, we help both individuals and organizations fight back against phishing attacks and fraudulent payment schemes. Our team conducts forensic email analysis, traces IP addresses of scammers, and works with financial institutions to block fraudulent transactions. For businesses, we investigate Business Email Compromise cases and implement protective systems to prevent future attacks.

Beyond recovery, we also focus on prevention through awareness and training. We teach clients how to recognize suspicious links, identify fake invoices, and verify payment requests before acting. Cyber resilience begins with knowledge, and we make sure our clients are fully equipped to outsmart these threats.

👉 If you or your business has fallen victim to phishing or fake payment requests, contact us immediately. Acting fast can stop further damage and increase the chances of recovering your lost funds.

Business Email Compromise (BEC)

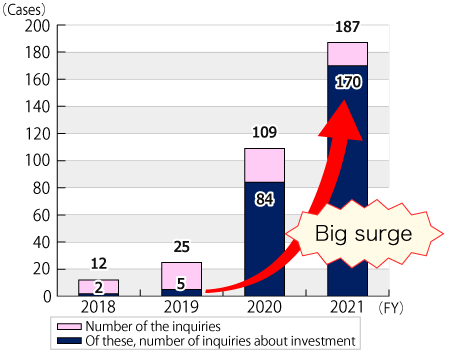

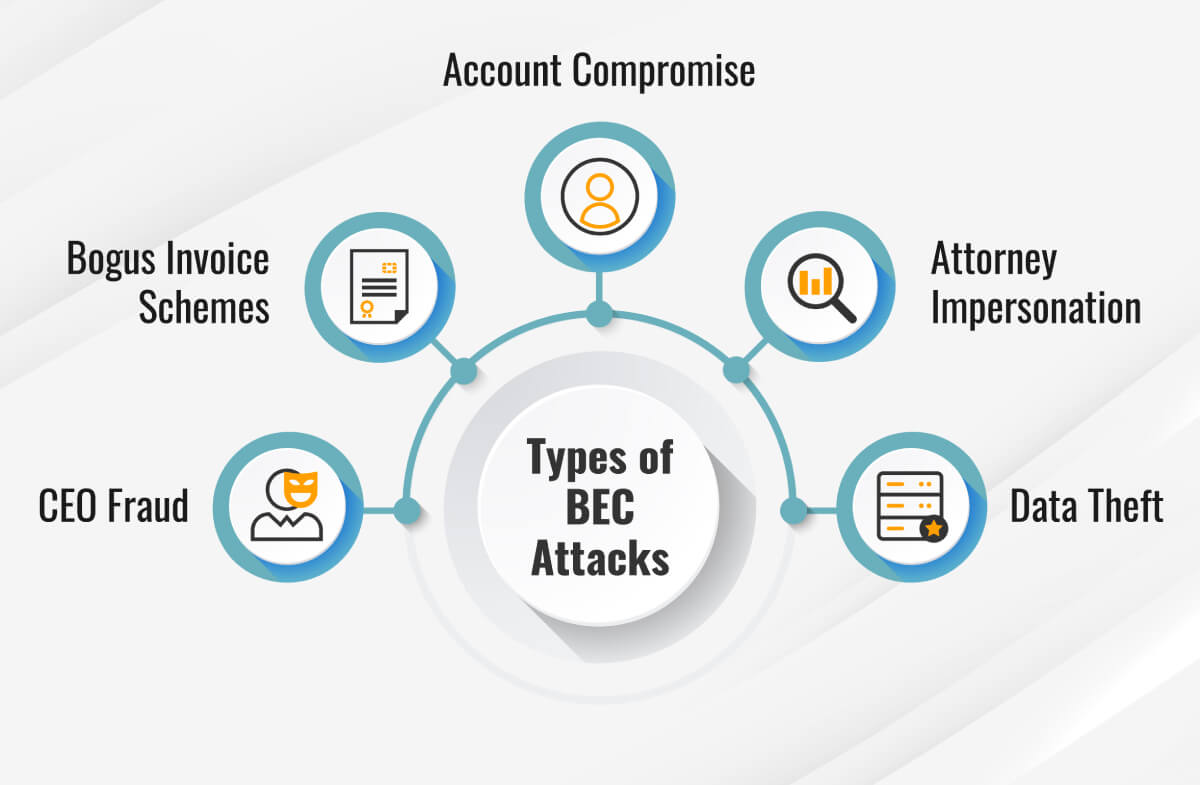

Business Email Compromise (BEC) is one of the most dangerous and financially damaging online frauds targeting companies worldwide. Unlike ordinary phishing scams, BEC attacks are highly sophisticated, well-planned, and tailored to exploit trust within an organization. Criminals gain access to, or impersonate, a company’s email account to send fraudulent instructions—usually payment requests—that appear completely legitimate.

What makes BEC especially dangerous is that it often bypasses traditional security measures. The emails don’t usually contain malicious links or attachments, making them harder to detect. Instead, they rely on social engineering and the manipulation of human trust. Victims may believe they are following direct orders from their CEO, CFO, or a trusted supplier, only to later discover they have wired funds to a criminal’s account.

How It Works

A BEC scheme often begins with criminals either hacking into a corporate email system or creating a convincing spoofed email address that looks nearly identical to a legitimate one. Once inside, they carefully monitor conversations, payment schedules, and business workflows. Timing is crucial—they wait for moments when employees are least likely to question instructions, such as during holidays or at the end of financial reporting periods.

According to the FBI’s Internet Crime Complaint Center (IC3), Business Email Compromise has caused over $50 billion in global losses between 2013 and 2023, making it one of the costliest forms of cybercrime. Unlike ransomware or phishing, BEC doesn’t require technical exploits—it succeeds because it manipulates human psychology and established business processes.

Optimization Statistics

Common strategies include:

CEO Fraud: Impersonating top executives to instruct urgent wire transfers.

Vendor Invoice Scam: Sending fake invoices that mirror real suppliers.

Payroll Diversion: Tricking HR staff into redirecting employee salaries to criminal accounts.

Attorney Impersonation: Pretending to be a company’s legal representative to demand confidentiality and fast payments.

For businesses, these attacks can be devastating. Not only are large sums of money lost, but sensitive data may also be stolen. Even worse, trust between employees, clients, and partners can be permanently damaged.

In many cases, funds stolen through BEC are immediately moved across multiple international accounts, making recovery extremely difficult if not reported quickly. Small and medium-sized enterprises are particularly vulnerable because they often lack the robust cybersecurity infrastructure of larger corporations.

We Will Be Useful to You

At Jitte Rex Tech, we specialize in investigating Business Email Compromise cases and recovering stolen funds. Our team performs deep forensic analysis of compromised email accounts, traces the movement of funds across global financial networks, and works with law enforcement and banking institutions to stop fraudulent transfers.

We also help organizations build resilience by implementing multi-factor authentication, secure email gateways, and staff awareness training. Preventing BEC is not only about technology—it is about teaching employees how to spot unusual requests, verify transactions, and slow down when pressured by urgency.

👉 If your business has been targeted by Business Email Compromise, contact us immediately. The faster you act, the higher the chance of recovering lost funds and protecting your organization from future attacks.

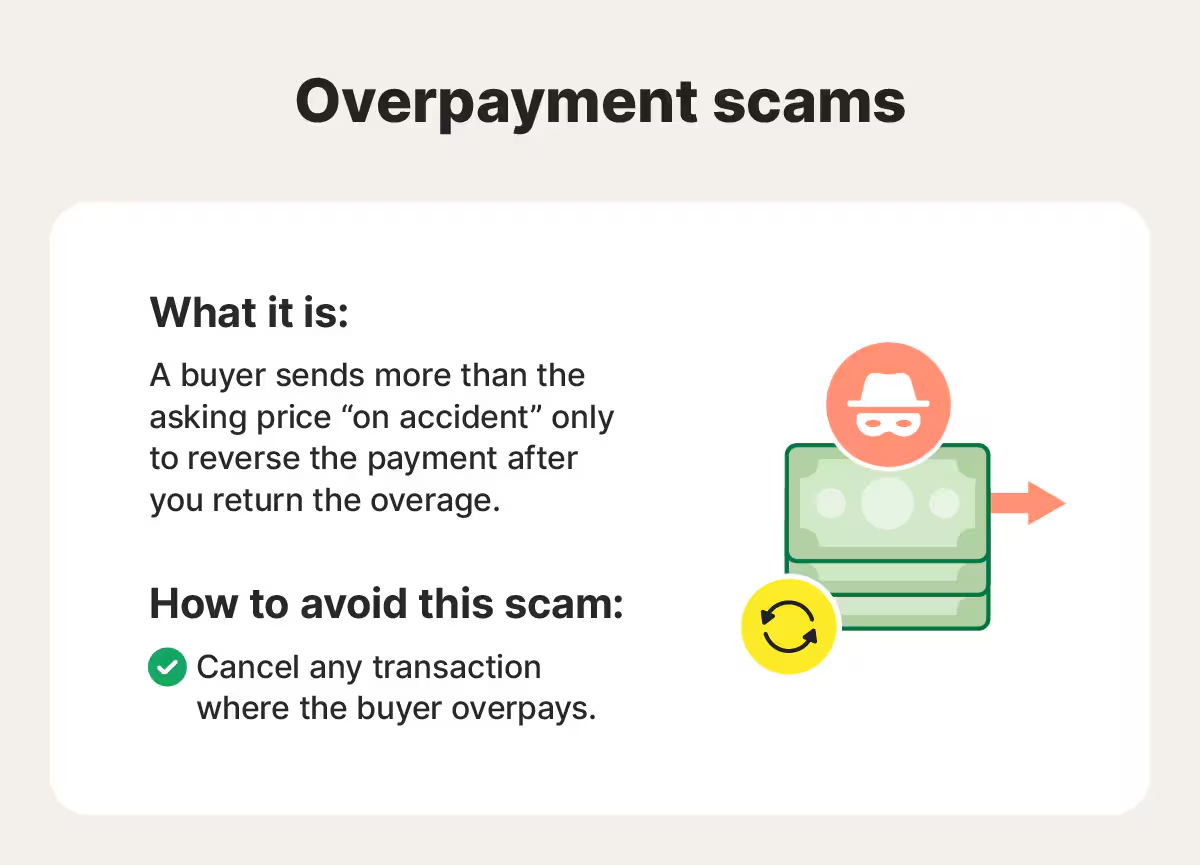

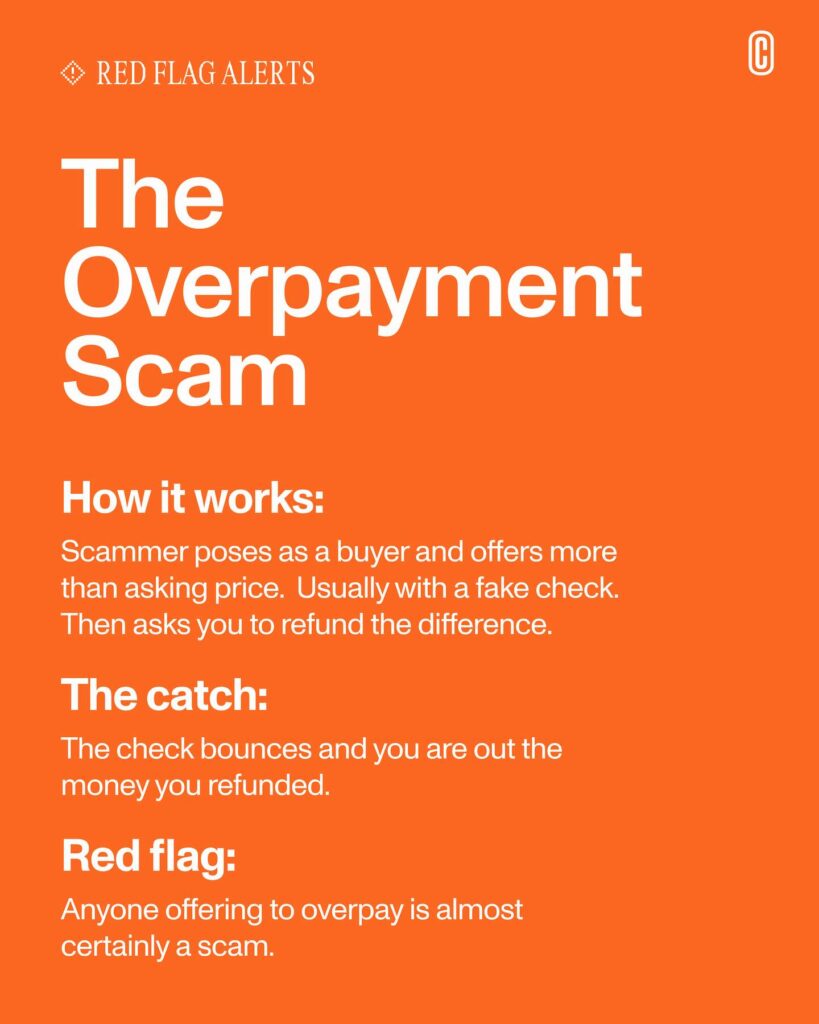

Overpayment & Refund Scams

Overpayment and Refund Scams are deceptive schemes where fraudsters trick individuals or businesses into refunding money that was never legitimately paid to them in the first place. These scams usually occur in online marketplaces, freelance platforms, or small businesses dealing directly with clients. The criminal’s goal is to create confusion around payments, making the victim believe they’ve received excess money and must return the difference—when in reality, the payment is fake, stolen, or later reversed.

This type of scam exploits human honesty. Most people feel compelled to correct mistakes, especially when they believe they’ve received more money than they should. Scammers use this psychological trigger to their advantage, creating urgency and pressuring victims to act quickly before they realize what has truly happened.

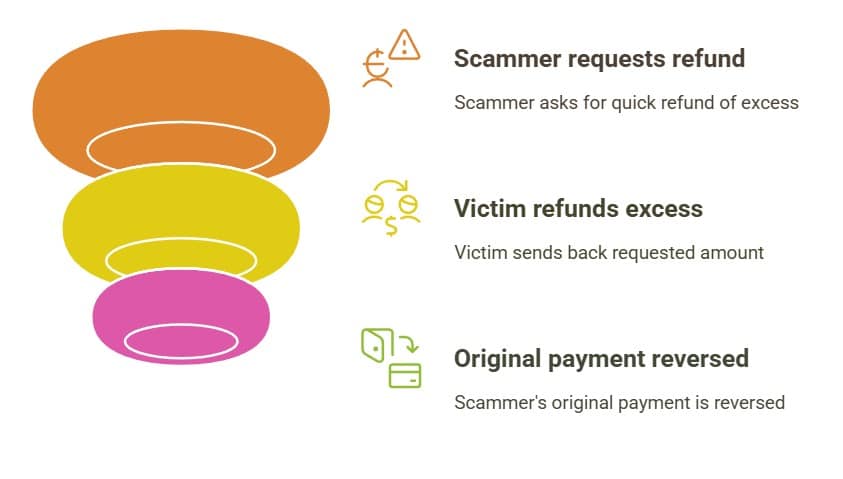

How It Works

An overpayment scam usually begins when a scammer “purchases” a product or service and deliberately sends more than the agreed amount. The extra payment might come through a stolen credit card, a counterfeit check, or a manipulated online transfer. Shortly after, the scammer contacts the victim, apologizes for the “mistake,” and asks for a partial refund of the excess amount.

By the time the victim sends the refund, the original payment is either canceled, reversed, or flagged as fraudulent—leaving the victim with a financial loss.

Another variation is the fake technical support refund scam, where fraudsters pose as customer support agents and convince victims they’ve been refunded too much money. Victims are pressured to “return the excess” to correct the supposed error, not realizing that no genuine refund was ever processed.

The scam thrives on urgency. Victims are pushed to act fast before banks or payment platforms have time to detect the fraudulent transaction.

Overpayment scams have become increasingly common on platforms like Craigslist, eBay, Facebook Marketplace, and freelance job boards, where trust between buyer and seller is built quickly but verification is often weak. According to consumer protection agencies, thousands of victims report such scams every year, with losses ranging from a few hundred dollars to several thousands per transaction.

Businesses that fall prey may not only lose money but also suffer chargebacks, account freezes, or penalties from payment processors. Freelancers and small business owners are particularly at risk since they often deal directly with clients and may not have fraud-detection safeguards in place.

We Will Be Useful to You

At Jitte Rex Tech, we help victims of overpayment and refund scams trace fraudulent payments, recover lost funds, and secure their accounts against further exploitation. Our forensic experts analyze transaction trails, identify the source of fraudulent activity, and collaborate with banks and platforms to pursue restitution.

More importantly, we educate individuals and businesses on how to identify red flags, such as clients who overpay with unusual methods, insist on fast refunds, or create unnecessary urgency. By building awareness and establishing safer payment practices, we reduce the chances of such scams succeeding in the first place.

👉 If you have fallen victim to an overpayment or refund scam, contact us immediately. Time is critical in reversing fraudulent transfers and preventing further damage.

Rental & Real Estate Scams

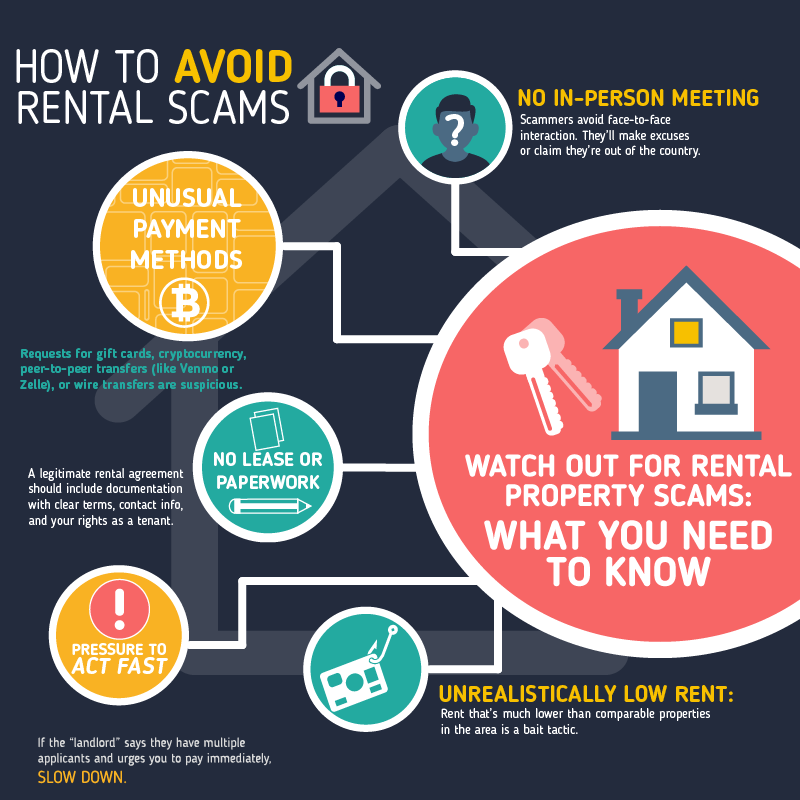

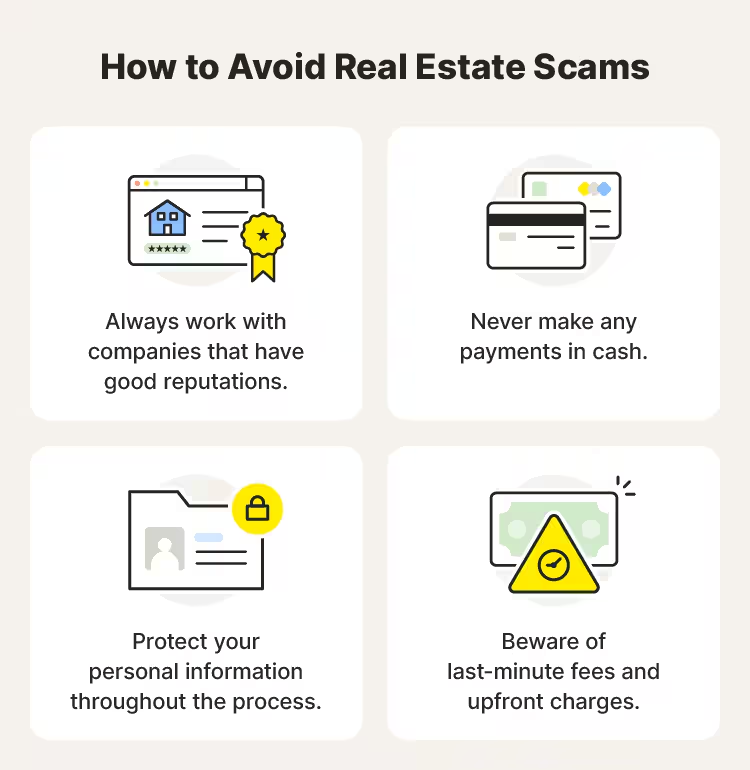

Rental and Real Estate Scams are fraudulent schemes where criminals exploit people searching for housing, rental properties, or investment opportunities. These scams target individuals who are often under pressure to secure accommodation quickly—such as students, workers relocating to a new city, or families looking for affordable homes. By taking advantage of urgency, trust, and lack of property verification, scammers make victims pay deposits or full payments for properties that either do not exist, are not available, or are not legally theirs to rent or sell.

This type of scam can be emotionally and financially devastating. Victims not only lose their money but are left stranded without a home, often at the last minute. In real estate investment scams, the losses can be even larger, wiping out life savings and retirement funds.

How It Works

A common form of this scam occurs when a scammer posts a fake property listing on popular rental websites, social media, or classified ads. The listing usually offers an attractive home at below-market prices to grab attention quickly. Once a potential tenant shows interest, the scammer creates urgency—claiming that there are “many interested applicants” and demanding that the victim pay a deposit, viewing fee, or first month’s rent upfront. In reality, the scammer has no rights to the property, and after payment, they vanish without a trace.

Another variation involves hijacking real property listings. Fraudsters copy legitimate listings from real estate websites, then repost them under their own contact details. Victims who fall for this trap may even visit the property (since it’s real) but unknowingly deal with an impersonator who collects their money fraudulently.

In real estate investments, scammers lure people with fake land sales, ghost developments, or fraudulent housing schemes. Victims often only realize they have been scammed after investing large sums, only to discover that the land title is fake or the property project does not exist.

Reports of rental scams have increased globally, with millions of dollars lost every year. According to the FBI’s Internet Crime Complaint Center (IC3), thousands of victims file complaints annually, with many losing between $500 to $5,000 per incident. Real estate investment scams cause even higher damages, often involving tens or hundreds of thousands of dollars per victim.

The psychological toll is also severe—victims often end up homeless, scrambling for emergency accommodation, or financially ruined after trusting what seemed like a legitimate property deal.

We Will Be Useful to You

At Jitte Rex Tech, we specialize in helping victims of rental and real estate scams recover lost funds, trace fraudulent property transactions, and build strong legal cases against scammers. Our digital forensic team works with banks, real estate authorities, and law enforcement to track down fraudsters and strengthen your chances of restitution.

We also provide education and verification services. Whether you are about to rent a property, buy land, or invest in real estate, we can verify ownership documents, cross-check property titles, and ensure you’re dealing with legitimate sellers or agents.

👉 If you’ve fallen victim to a rental or real estate scam, or if you are about to commit to a deal and want to avoid being scammed, contact us immediately. Protect your money and your future.